Q2/Q3 2024 Earnings Review -3

In this post we will cover the companies who have reported their results

CDSL

JM Financial

CDSL

CDSL had another fantastic quarter, the market activity has been on upswing so there market related revenues have seen huge upswing. you can read the detailed results here or look at investor presentation here

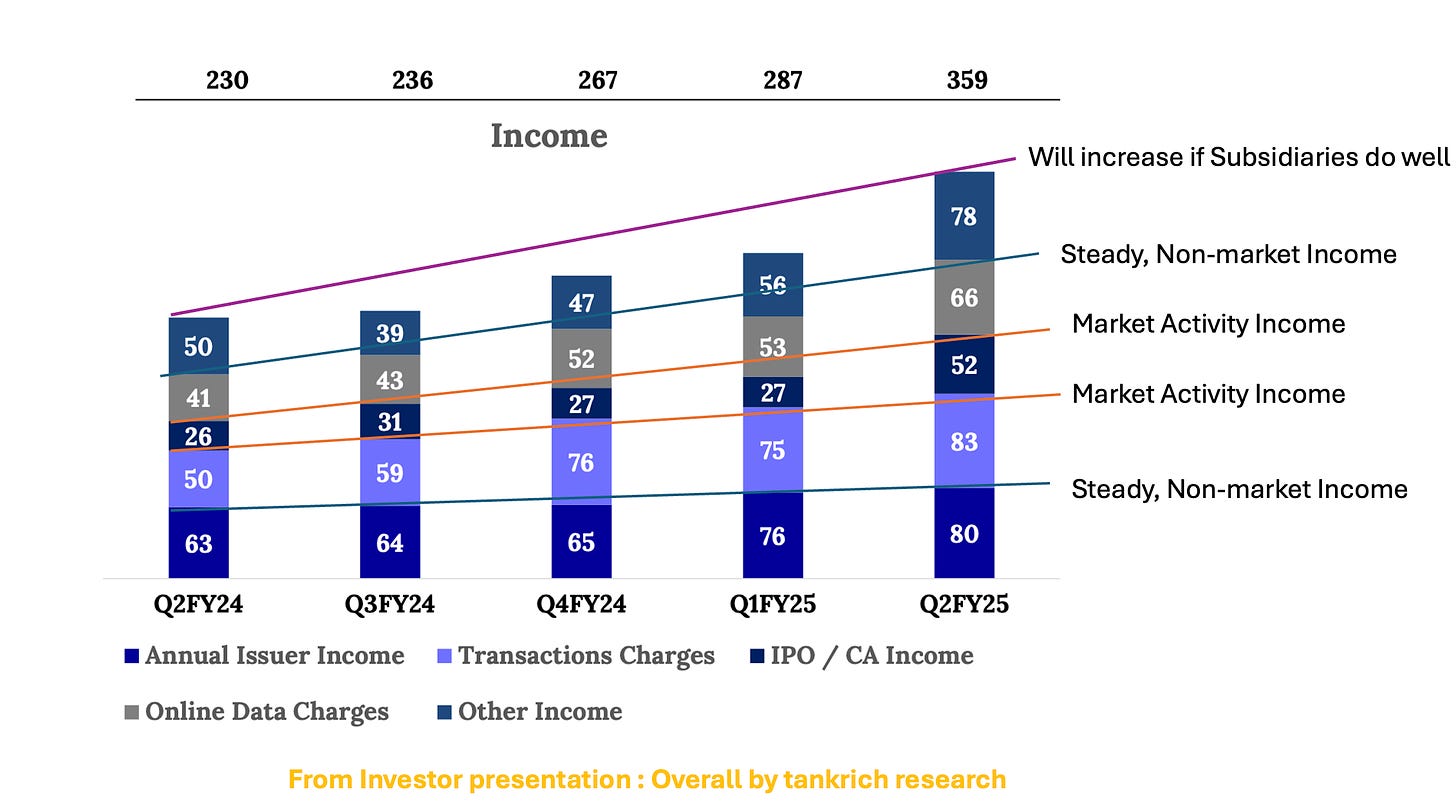

a 56% increase in total income for the quarter ended September 2024, reaching INR 359 crore compared to INR 230 crore in the same period last year.

Net profit for the quarter increased by 49% to INR 162 crore

The company added about ~2 crore DMAT accounts in the first six months of FY24-'25, indicating robust growth in user base

As markets cool down overall their market linked income will come down, but I am not worried about it too much as regulator is constantly finding ways to add more to their kitty

In a significant move aimed at enhancing the security, efficiency, and transparency of shareholding management, the Government of India has mandated that all private companies, excluding small and government companies, must convert their physical shares to electronic form by September 30, 2024. This requirement, introduced by the Ministry of Corporate Affairs (“MCA”) through Rule 9B, marks a substantial shift in how private companies manage their securities.1

The quality of income is also improving

why I am saying that ?

Issuer charges have increased by 26%

Online Data income has increased by 60%

Subsidiaries are delivering well as other income is also improving

Things to watch out for

One thing to watch out for is that one of the long term holder, PPFAS mutual fund is selling and reducing stake probably indicating that fair value is achieved and near term weakness in markets could potentially derate the business

Transaction charges income is likely to go down, effect from 1st of October where single charge as per SEBI circular would be levied, 23% of revenues came from this segment

JM Financial

Keep reading with a 7-day free trial

Subscribe to Tankrich to keep reading this post and get 7 days of free access to the full post archives.