PayPal (NASDAQ :PYPL) is one of the most important online payment platforms in the world, it allows individuals and businesses to send and receive money electronically. Its core business model is centred around providing secure, easy, and quick online payment solutions.

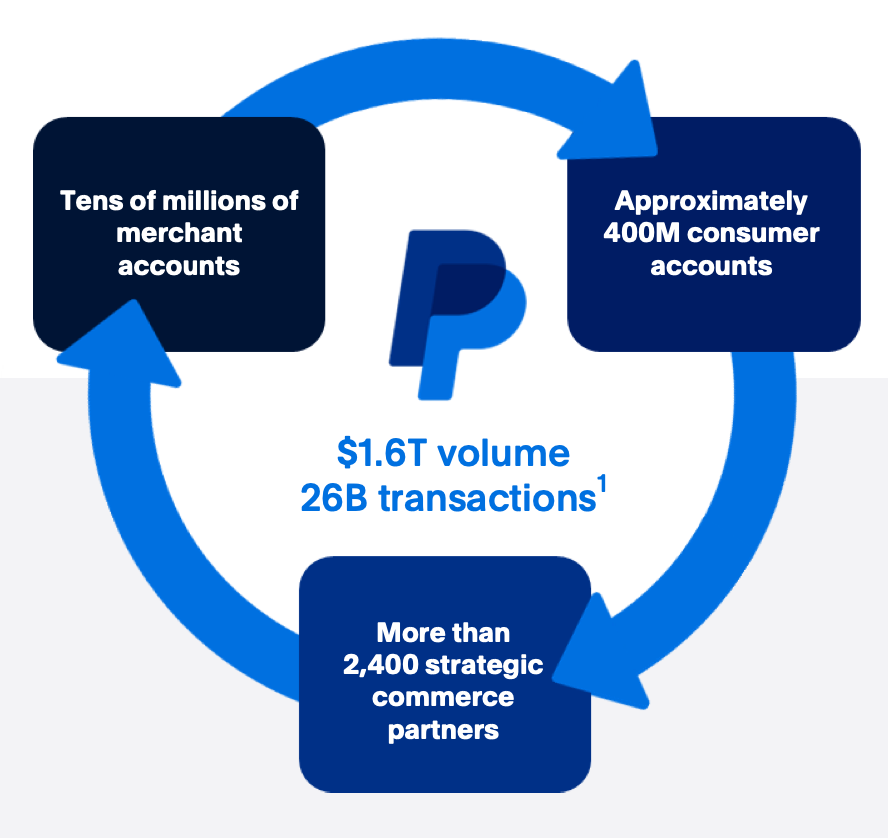

Below image perfectly captures the PayPal’s eco-system1

Before we delve into where the business is today lets understand its past

In 1998, the company was founded to create the world’s first digital payment platform, making money work better, faster and easier than ever. Its popularity and adoption was because it was official payment provider to fast growing e-commerce market place e-bay. Fast forward in 2015 it is carved out of e-bay and became its own independent company operating in almost 190 countries in the world2.

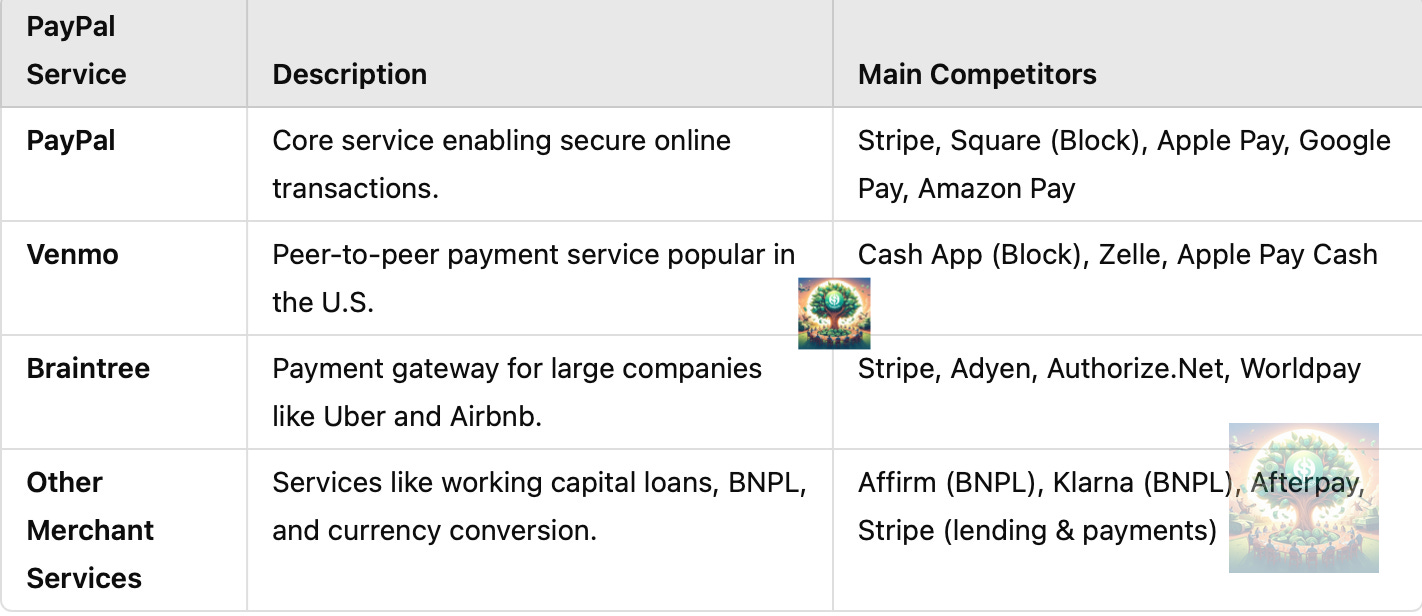

Today company operates via 4 major verticals

PayPal: The primary service enabling secure online transactions.

Venmo: A peer-to-peer payment service popular in the U.S. for sending money to friends and family.

Braintree: A payment gateway that allows large companies (e.g., Uber, Airbnb) to process payments.

Other Merchant services : PayPal earns revenue from services like working capital loans, currency conversions, and credit services,Provides short-term loans and Buy Now, Pay Later (BNPL) options to customers.

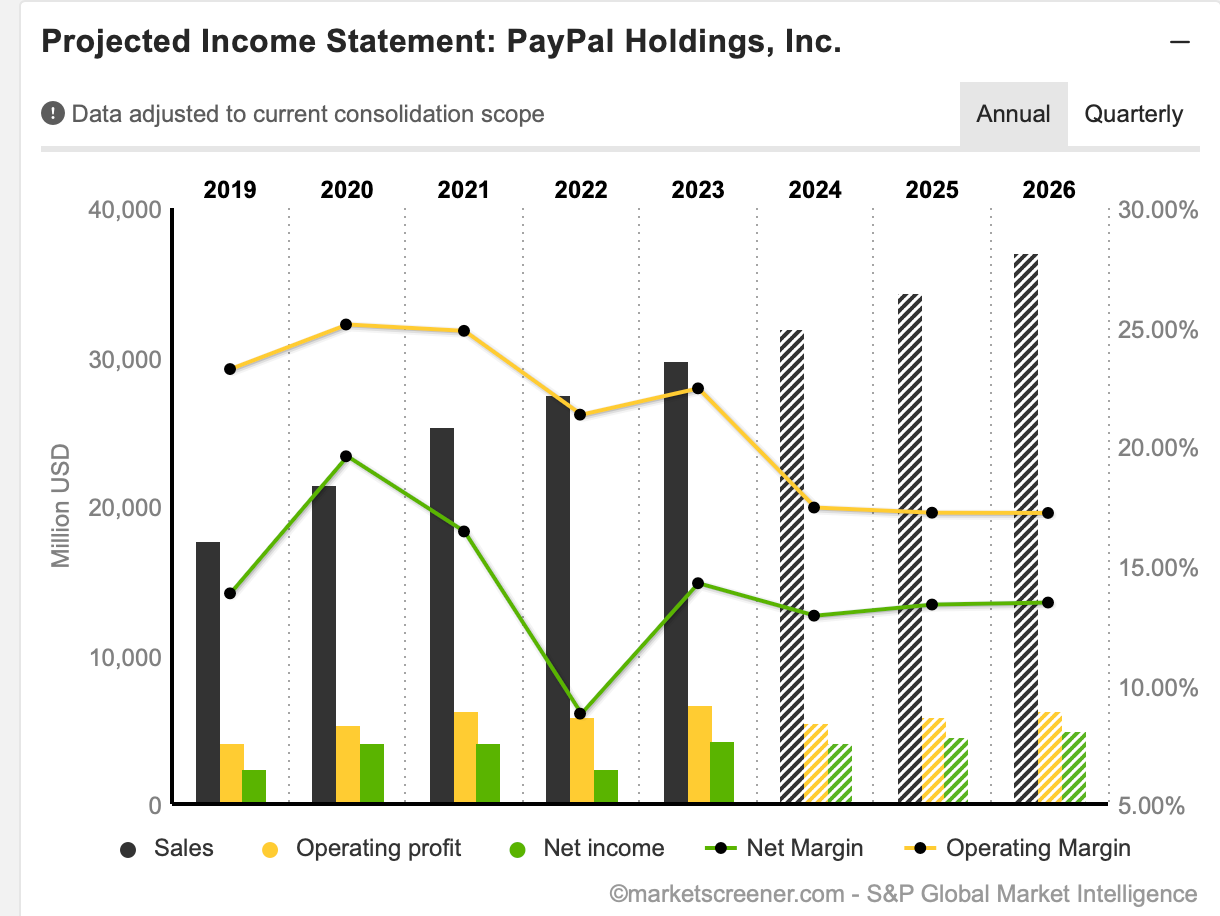

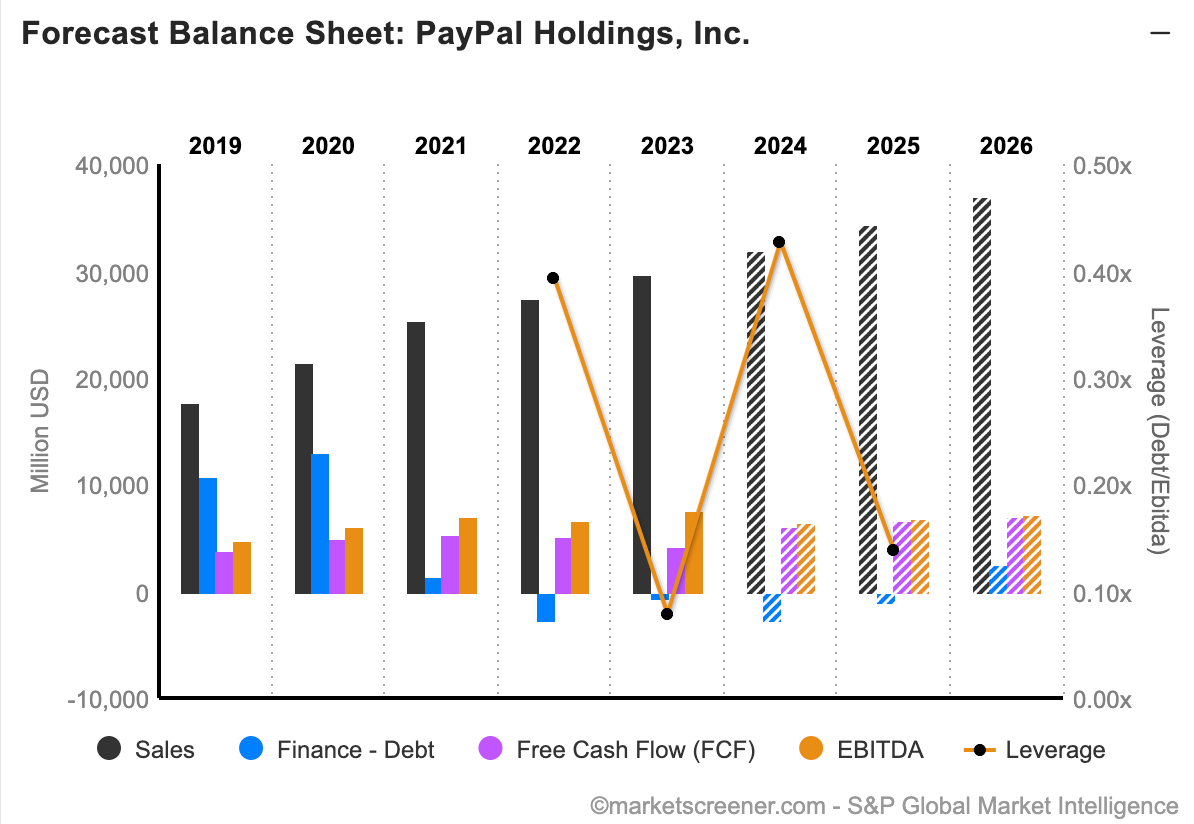

The fundamentals at least from a macro view are fine, the sales have been consistently higher and margins are back to pre-covid levels3

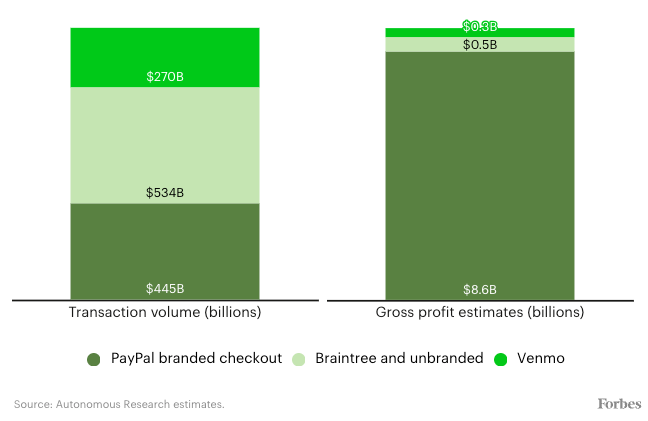

However Mr Market thinks that’s it biggest money maker is under attack, the PayPal button4

The PayPal button that we see on most merchant sites brings lion share of all revenues5

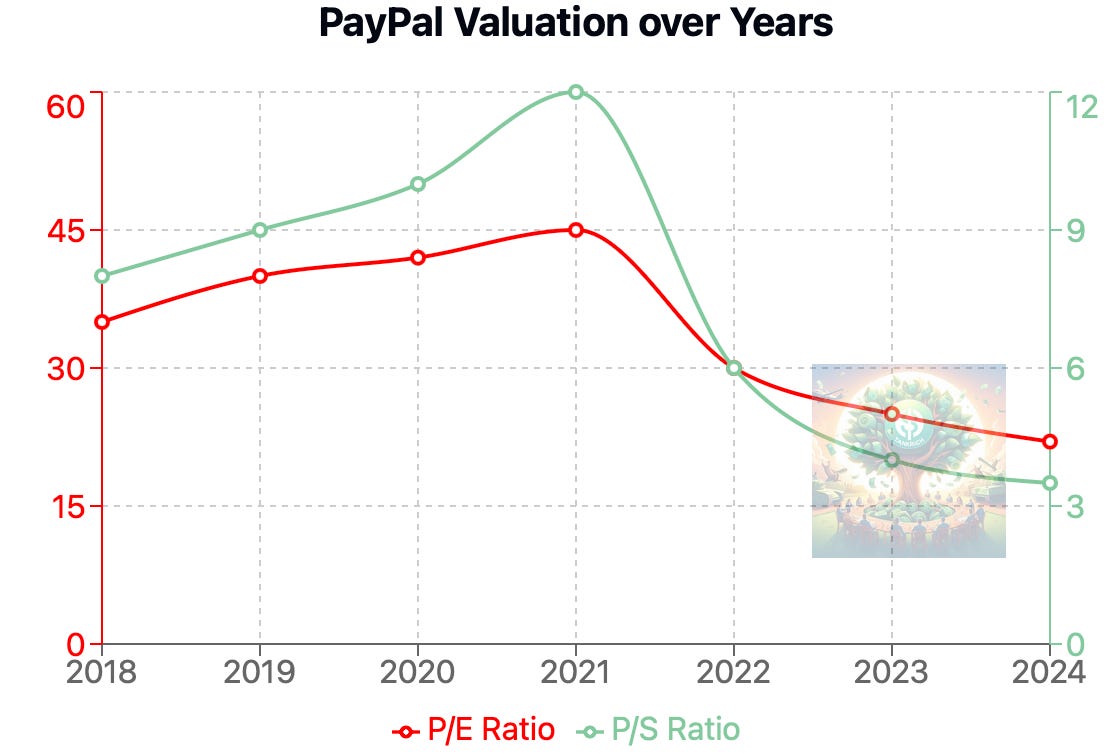

The stock is down 75% from its peak price of $310 per share in 20216 it faces stiff competition in each of its business segments

Lets analyse each of these business segments

A) Paypal button or core payment service is under a serious threat from Apple, Google and Amazon as each of them have their own competitive service. Among this Apple Pay after its roll out is having amazing adoption7

Apple Pay's transaction volume—the service handles over 1.8 billion transactions quarterly—is also astounding. This shows a 40% year-over-year rise in favor of Apple Pay among customers, underscoring their developing inclination for it. With 92% of all payments in the US mobile debit wallet industry, the service's dominance is especially clear-cut. More than 90% of US retail establishments and 60% of retailers worldwide accept Apple Pay, further demonstrating its widespread acceptance.

Apple Pay, Google Pay and Amazon all gain from their ecosystem, if you want to understand how powerful the eco-system concept is watch this video8

These systems generate coherent, linked experiences that inspire consumer loyalty and higher use of goods and services.

PayPal has its own ecosystem, Paypal button , Venmo, Braintree, Xoom but its is nothing compared to the might of Apple, Amazon and Google9

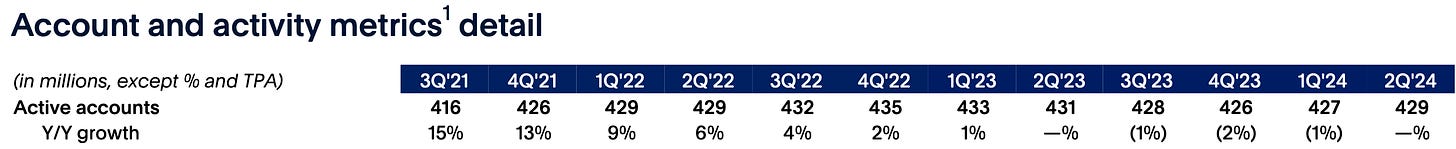

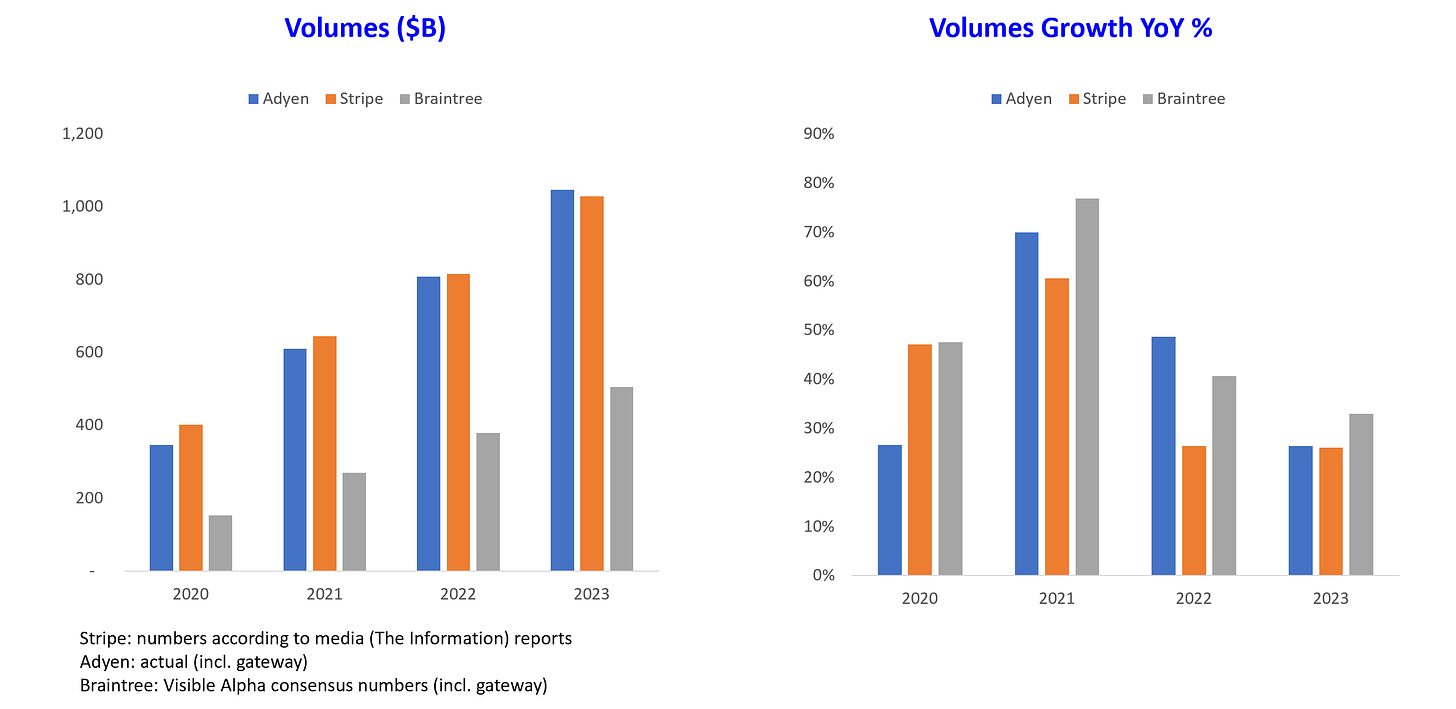

On one hand while Apple is growing number of active accounts 40% year over year10 , Paypal is stuck at same number of active accounts as it had in 2022

the good bit is that they are staying relevant, both the average transaction per account and number of transactions are moving up

To mitigate this company is building and launching FASTLANE

Fastlane is PayPal's new innovation (or copy of Amazon 1 click pay, Apple Pay 1 click checkout) designed to streamline guest checkout for online shoppers, enhancing the experience for those who don’t have a PayPal account. Its main goal is to reduce friction during checkout by allowing faster and simpler payment processes, especially for guest users who often abandon their carts due to lengthy forms.

There internal testing and early results show that Fastlane boosts conversion rates significantly, with PayPal reporting an 80% conversion rate compared to the industry average of 50%

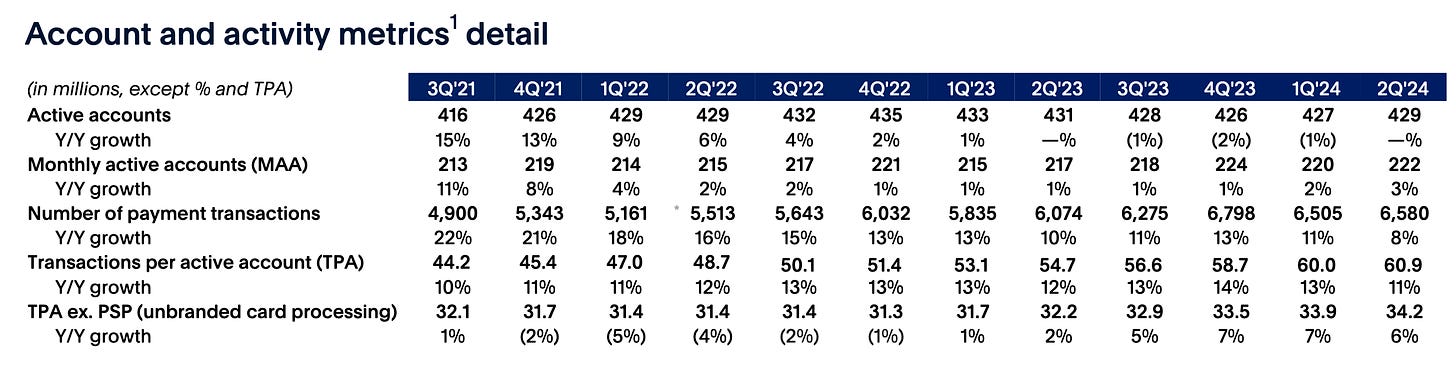

B) Venmo is a verb, Yes, "Venmo" has become so widely used that it's often used as a verb in everyday conversation, much like how people say "Google" something. When someone says, "I'll Venmo you," it means they’ll send you money using the Venmo app. This is a testament to how integrated Venmo has become in people’s lives in USA, especially for quick, casual money transfers between friends or for small payments.

Its tremendous growth can be visualised below

However so far for Paypal it’s been a cash burning vertical, bringing transactions, users but little or no profits. The management is trying to change this

PayPal is monetizing Venmo through a multi-faceted approach that transforms the app from a simple peer-to-peer payment service into a comprehensive financial platform. Key strategies include introducing Venmo-branded debit and credit cards, charging fees for instant transfers to bank accounts, enabling business profiles with associated merchant fees, facilitating in-app purchases, offering cryptocurrency trading, expanding payment options to PayPal merchants, partnering with brands for cashback offers, providing tools for small businesses, implementing QR code payments, and exploring potential advertising opportunities. These diverse revenue streams aim to increase user engagement and generate income while maintaining Venmo's user-friendly appeal and expanding its utility in users' daily financial activities.

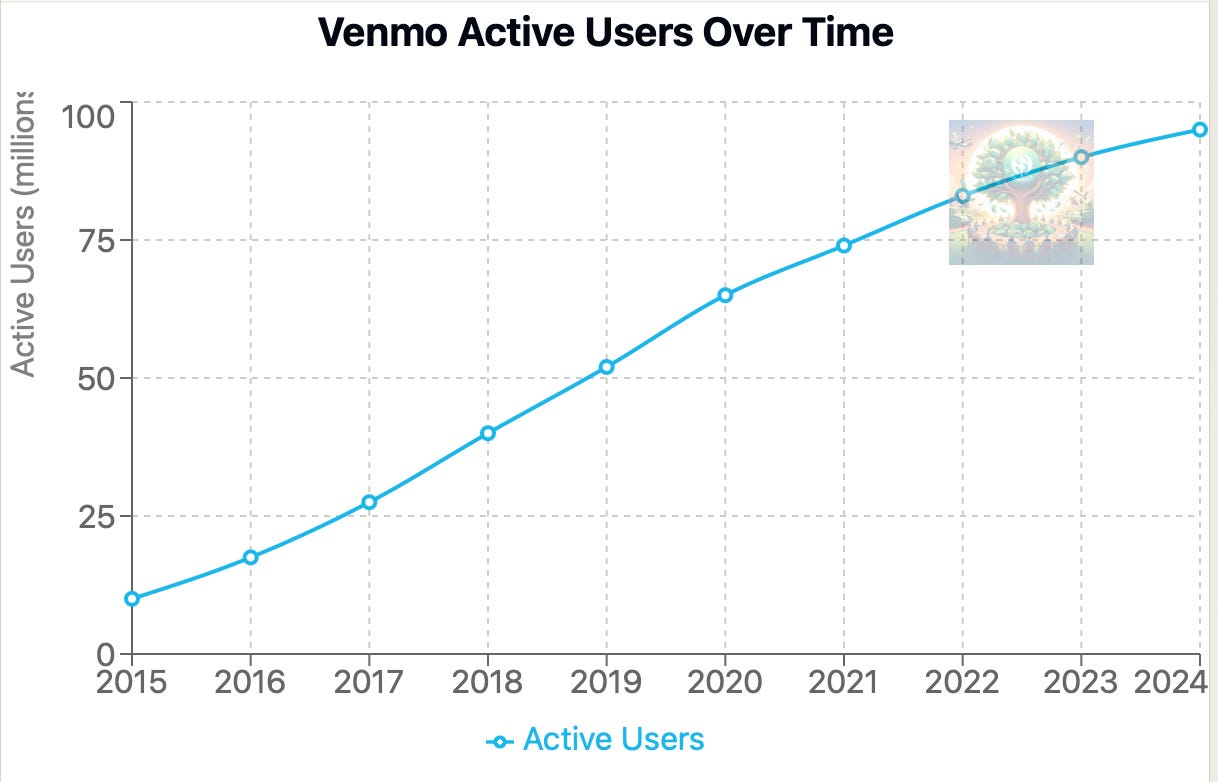

C) Braintree allows businesses to accept card payments directly, and PayPal earns fees from these transactions. it is used by large enterprises like Uber and Airbnb and Meta. It is number #3 behind top 2 Adyen and Stripe but growing faster than them.

The biggest driver of our shift in TE right now has been Braintree, and that continues to be what is happening there.

This is their Crown Jewel, transactions value increasing and volumes are also growing11

The company’s balance sheet has become Net Debt free and throwing ~USD 6Billion of cashflow every year

The company is available at historically low valuations

Lets summarise key positive factors

New Leadership: Under new CEO Alex Chriss, PayPal is refocusing on its core strengths and making strategic decisions to drive profitability.

Undervaluation: PayPal appears undervalued based on various financial metrics, with potential for long-term growth.

Share Buybacks: PayPal is retiring shares, which could drive up stock value as outstanding shares decrease.

Product Innovation: Initiatives like Venmo and Braintree are expected to contribute positively to margins, with higher transaction fees helping to improve profitability.

Positive Analyst Expectations: Analysts forecast growth in sales and EPS in the coming years, indicating potential upside.

What are some of negative factors

Loss of core business to Apple, Google, Amazon

Fintech landscape is highly competitive, with Stripe and Adyen continuously innovating, which could pressure Braintree market share and margins12

While focusing on profitability, there might be short-term impacts on growth initiatives and customer acquisition, which could affect long-term revenue potential

Venmo’s monetisation efforts could fail

My take

If somehow Paypal doesn’t grow and stop at their current performance (USD 6 Billion Free Cash Flow) then it will return its market cap (USD 83 Billion Dollars) in 13 years juicy FCF yeild13

I am long and would watching management execution closely

Happy Investing