Investing is often seen as a choice between two extremes—playing it safe with passive index funds or chasing high returns through aggressive trading. But what if you could get the best of both worlds?

Let me give you a thought experiment where you can gain from best of both worlds

This hybrid strategy allows build wealth steadily while capitalising on market inefficiencies when the right opportunities arise.

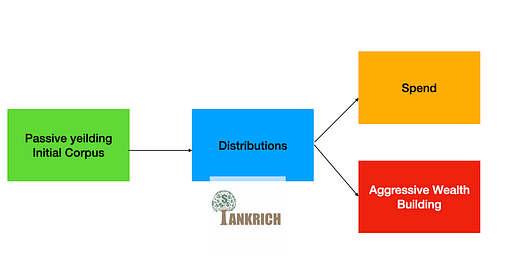

Wealth isn’t always about big wins or flashy moves. Sometimes it’s about planting a couple of trees, splitting the harvest, and letting the seasons do the rest. In this approach you start by investing your corpus in passive/safer yielding instruments and then use distribution from passive investments to invest in aggressive instruments the below diagram will help you understand this

Let me give you a simple example

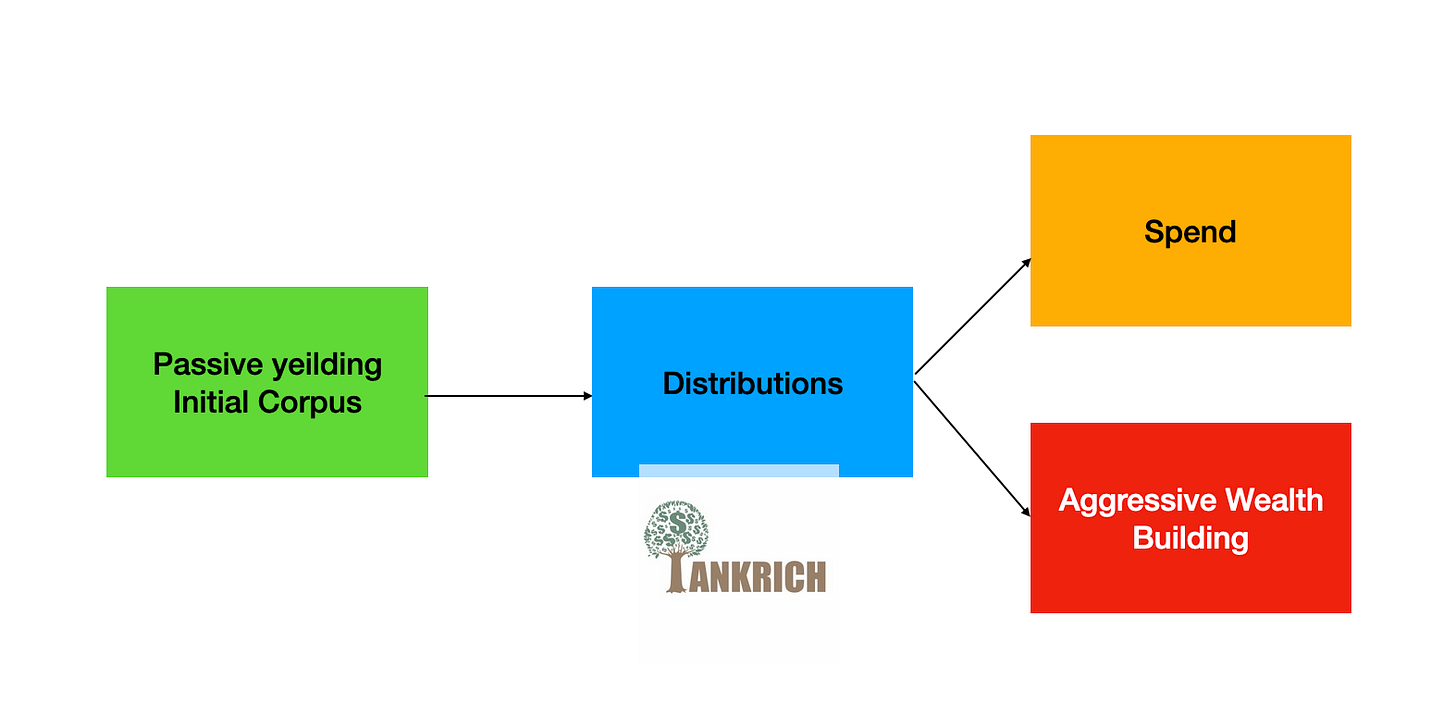

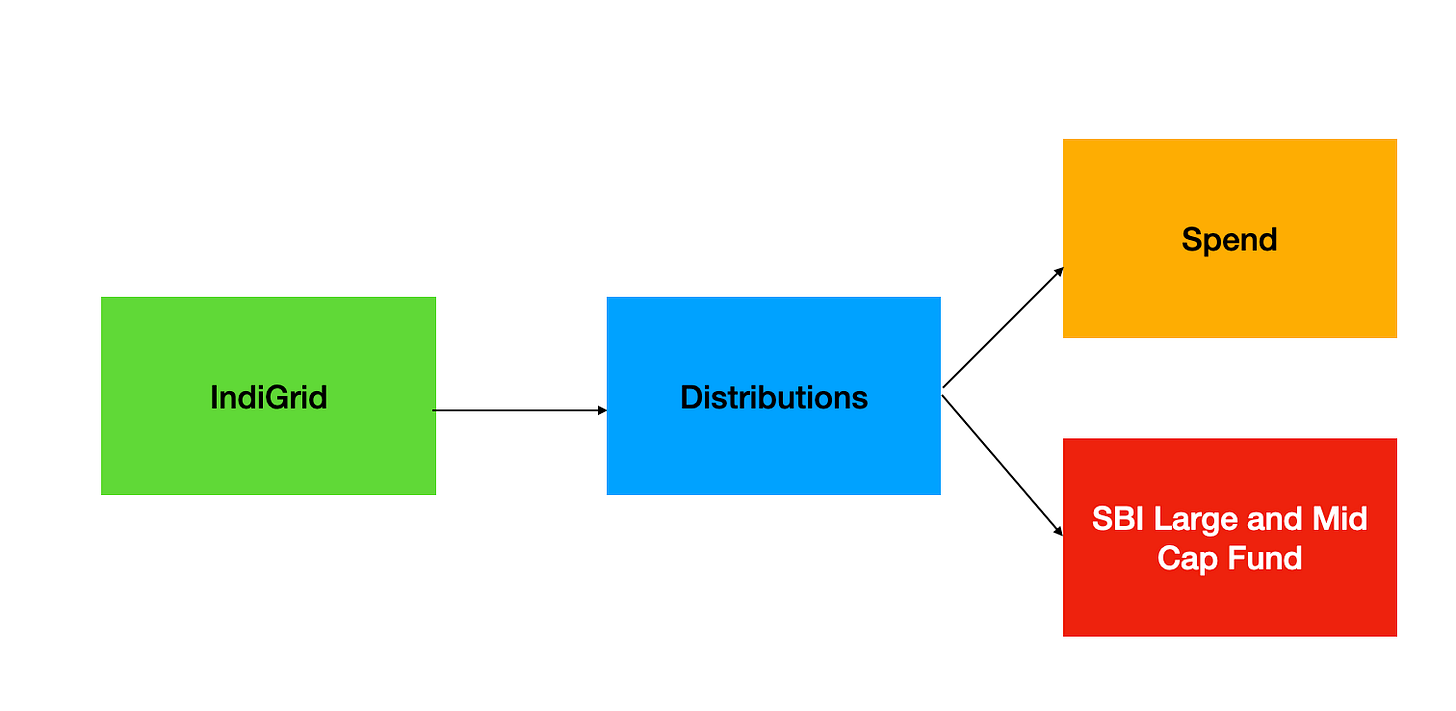

Imagine you decided to invest in a company called India Grid Trust (IndiGrid), which is like a business that owns and runs power lines and pays you money every few months (called distributions). Here’s how you went about it:

Buying In: Back in 2017, you bought 100,000 "shares" (or units) of IndiGrid for ₹100 each. You still have all 100,000 units today.

What Happens with the Money They Pay You: Every three months, IndiGrid sends you some money (like a little paycheque) based on how well they’re doing. You decided to split this money in half:

Half to Spend: You took 50% of this money and used it for whatever you wanted—like buying groceries, paying bills, or just treating yourself.

Half to Grow: The other 50% you didn’t spend. Instead, you put it into a different investment called the SBI Large & Midcap Fund. Think of this as a big piggy bank managed by experts who use your money to buy shares in lots of growing companies. Every time IndiGrid paid you, you added a bit more to this piggy bank.

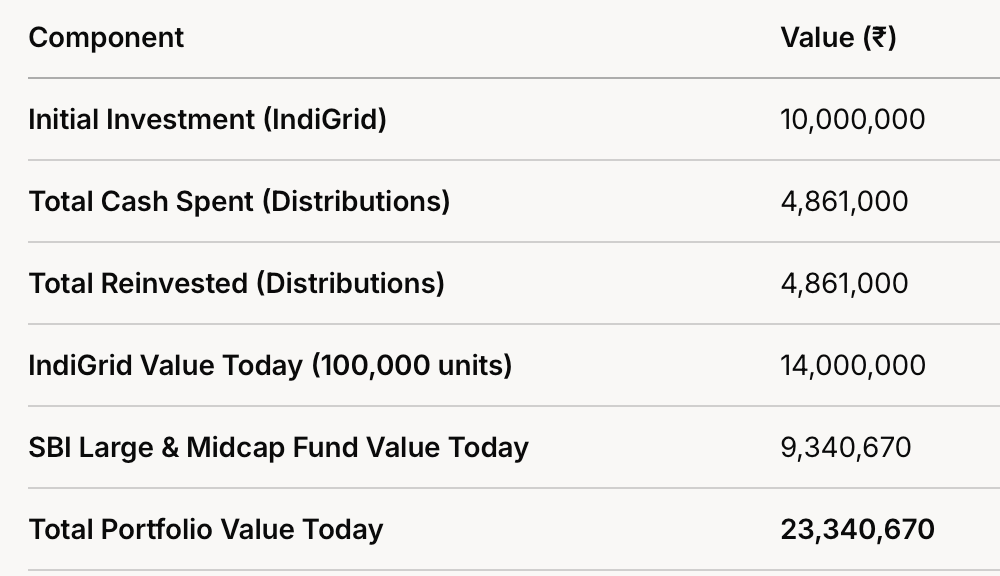

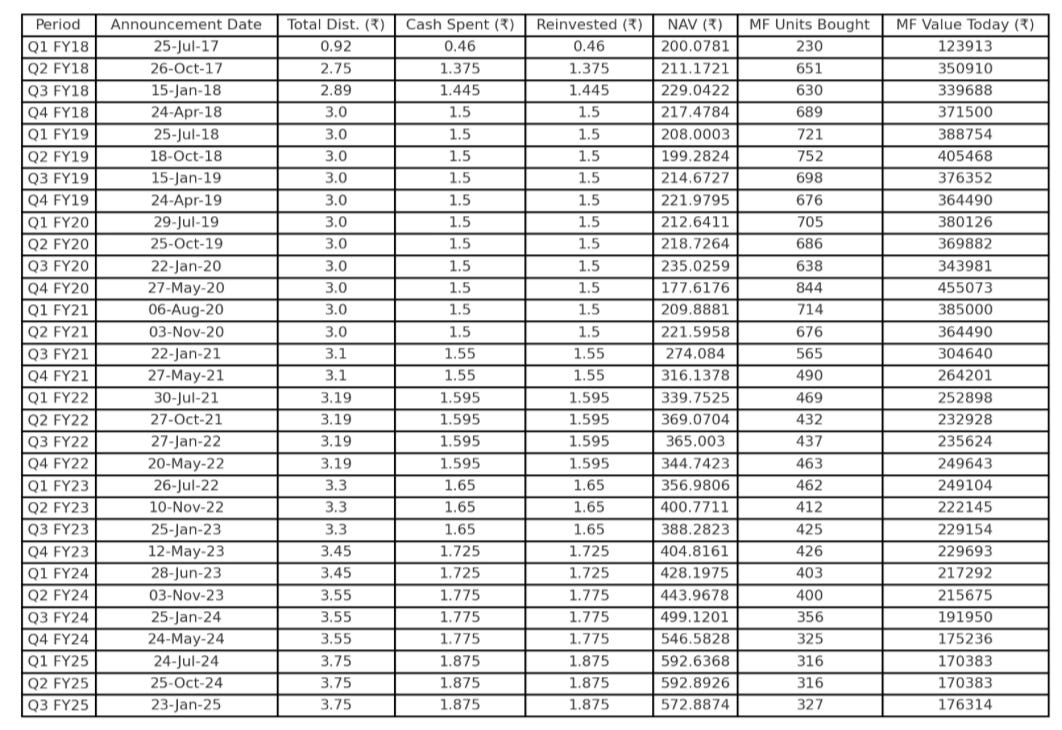

India grid has made 31 distribution over last 9 years, here is how overall picture would be today (Feb -2025) . The initial investment of INR 1 cr would be INR 2.34 cr growing at Compound Annual Growth Rate of 11.68% while allowing you to spend almost ~50% of your initial corpus in those 9 years

the reinvestments would like below

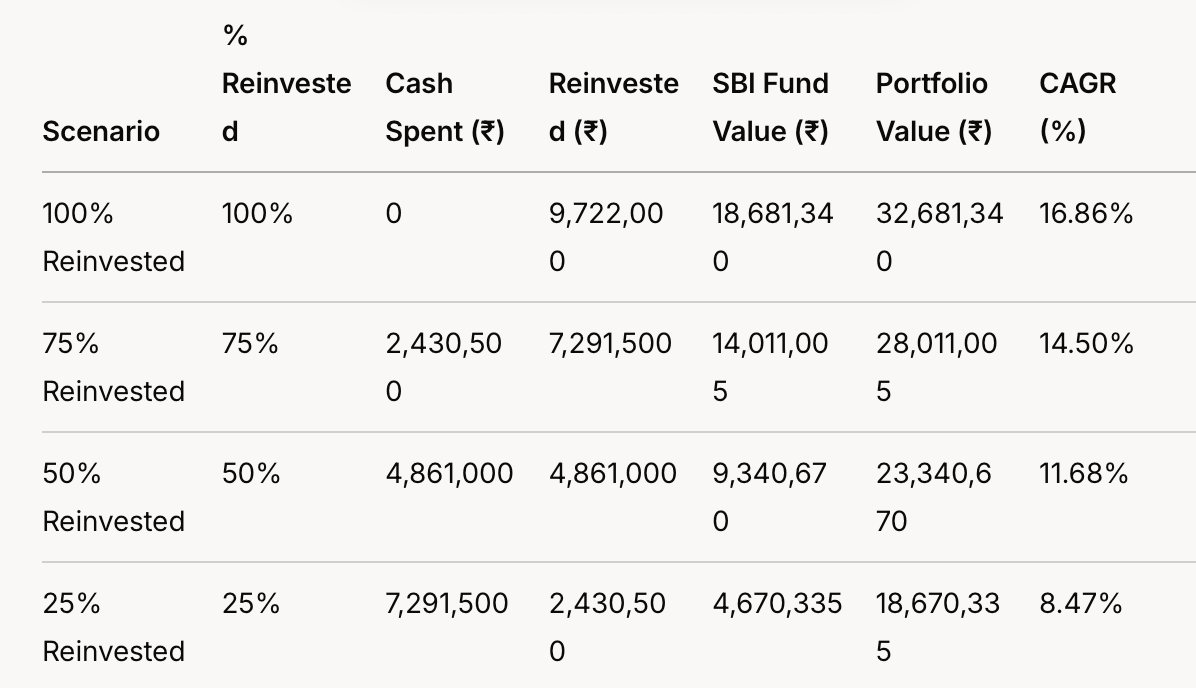

What if you chose not to spend and reinvest everything?

If 100% of distributions are re-invested than CAGR improves to 16.86%

Is this passive aggressive approach is better?

Nifty 50 generated ~ 12% CAGR for this period

SBI Mutual Fund used above generated ~14% CAGR for this period

With approx ~50% distributions used for life (family, holidays, education) and still getting to close to Nifty returns I will reader make that call. At 75% or 100% re-investment it was definitely beating both Nifty 50 and standalone mutual fund

Why ?

Dollar-Cost Averaging on Steroids

When you reinvest 100% of the distributions quarterly, you’re buying SBI fund units at different prices over 7.6 years—sometimes high, sometimes low. This is like dollar-cost averaging, but turbocharged because:

we are adding ₹300,000–₹375,000 every quarter, not a fixed amount.

Early purchases (e.g., ₹200–₹300 NAVs in 2017–2020) grew the most by 2025 (to ₹539.1868), while later ones (e.g., ₹500–₹600 in 2024–2025) added fewer units but still contributed. The big wins covid year quarters.

In contrast:

SBI Fund Alone: You buy all 49,981 units at ₹200.0781 on day one. It grows at 13.88% CAGR, but you miss the chance to buy more units at varying prices later.

Nifty 50: A single index tracking big companies grows steadily (11.84%), but without reinvested dividends it’s a one-shot ride from 9,934.80 to 23,500.

The 100% reinvestment strategy spreads the reinvestment, catching the SBI fund’s growth at multiple points, amplifying returns.

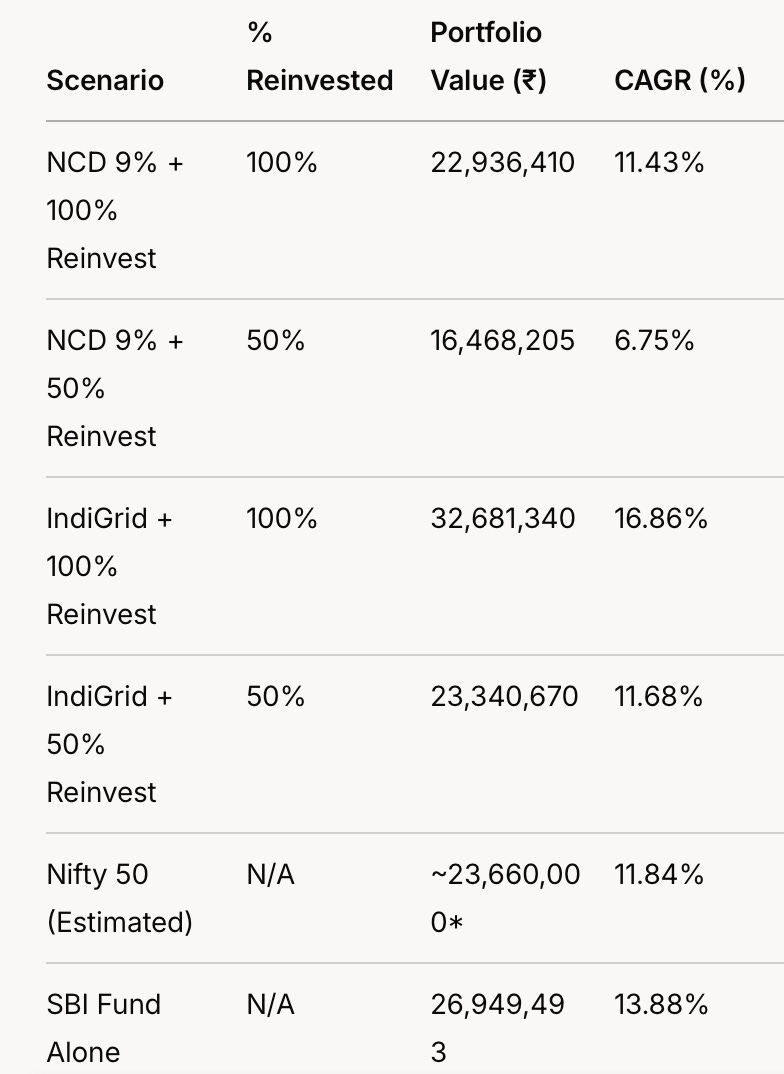

Will this work for pure debt instruments

with no capital upside ? I doubt I ran numbers with 9% FD/ NCD , in 50% reinvest scenarios for FD the CAGR is half of nifty 50 its better to be in nifty 50 in that case at 100% also it can’t beat passive nifty 50

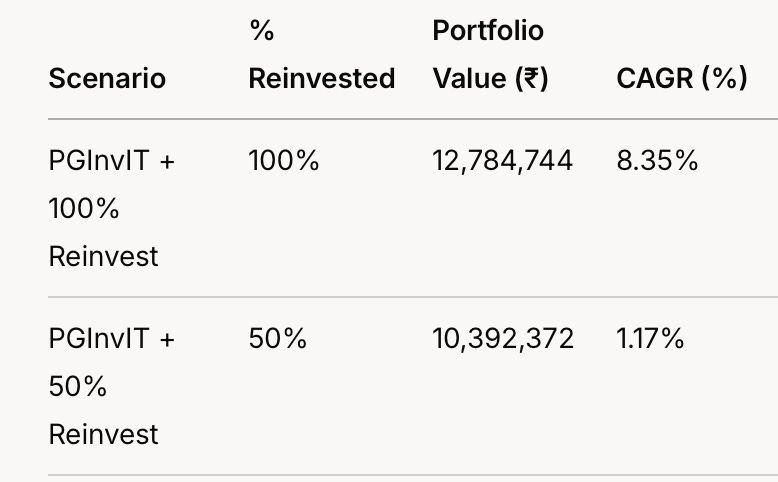

Did it work for other Grid Trust ?

No it didn’t even with 100% reinvested it didn’t work for PGINVIT because the trust has lost 20% of face value of units

The key learning from analyzing various scenarios of this distribution-splitting strategy is that its success depends heavily on selecting an underlying asset that offers

both consistent distributions and strong potential for capital appreciation

When paired with a high-performing reinvestment vehicle like the SBI Large & Midcap Fund, reinvesting distributions can significantly amplify returns over time, as demonstrated in cases like IndiGrid, where the asset grew in value. However, if the underlying asset declines, as seen with PGInvIT, even a strategy of full reinvestment cannot fully offset the capital losses. While the balance between reinvestment and cash flow (e.g., 50% vs. 100% reinvestment) and the investment horizon play roles, the choice of an asset with both yield and growth potential remains the critical factor in maximizing wealth, far outweighing the impact of reinvestment tactics alone.