MOIL – Debt Capacity Bargain ?

The rest of post is inspired by and adapted from this wonderful post on debt capacity bargains by Prof Sanjay Bakshi.

MOIL, a Mini Ratna, is India‘s largest producer of manganese ore accounting for ~50% of the country’s total output. At present, MOIL operates 10 mines, six located in the Nagpur and Bhandara districts of Maharashtra and four in the Balaghat district of Madhya Pradesh. All these mines are about a century old. Except three, rest of the mines are worked through underground method.

MOIL is a debt free company, here is a snap shot from 2014-15 annual report

How much money would you lend to MOIL against the security of its business ?

Other things remaining unchanged, it’s prudent to lend to large companies whose businesses are not cyclical. If a business is cyclical, then a prudent banker would not depend on peak earnings. Rather, he would compute average past earnings and then ask for a higher interest cover on those earnings than would have been the case if those earnings were not cyclical. ~ Sanjay Bakshi

Earnings of MOIL are not stable and dependent of future of steel industry and we know that the steel industry being cyclic in nature, manganese ore demand is exposed to growth of steel sector and its dependability,The cash flow generated from operations can swing, The cash generated from operations reduced from INR 7,610 million in 2014 to INR 2,214 million reducing by more than 50% , See the cash flow statement extract for last 5 years proving that this is a cyclical business

Add to that it has an idiosyncratic promoter (GOI- Government of India).

Since the 2015 numbers is less than average, Let’s assume that INR 2,214 million is sustainable cash flow going forward. To test that our assumption is conservative, I looked at projections of MOIL’s cash flow from operations used by Emkay research report

Assuming a sustainable cash flow of INR 2,214 million and interest coverage of 4X (MOIL is a positive cash flowbut cyclic business with largest market share), Therefore INR 553 Million as is the maximum amount of interest that MOIL’s business can easily afford.

Given that current interest rates for high-quality borrower are 8% p.a.(Recent tax free AAA bonds were issued as low as 7.64%) at present, this means that the maximum amount of debt that you will be pleased to give to MOIL comes to INR 6,920 Million.

We have now arrived at an important number of INR 6,920 Million as the debt capacity of MOIL’s operating business. Notice this debt capacity has been arrived at without considering any surplus cash in possession of the company.

Now let’s look at the cash on its books, The company has INR 28,298 million cash as per FY 2015 annual report

Interest earned forms significant part of it’s other income indicating most of this is excess cash on balance sheet.

“There are instances where an equity share may be considered sound because it enjoys a margin of safety as large as that of a good bond. This will occur, for example, when a company has outstanding only equity shares that under depression conditions are selling for less than the amount of the bonds that could safely be issued against its property and earning power. In such instances the investor can obtain the margin of safety associated with a bond, plus all the chances of larger income and principal appreciation inherent in an equity share.” Ben Graham

In MOIL’s case - Ben would take the debt-capacity of MOIL’s operating business INR 6,920 Million Then he would add the surplus cash of INR 25,468 million (90% of cash on books, He would then divide this number by 168 Million shares outstanding which comes to INR 192 per share. Ben Graham, the smart value investor, would be pleased to buy MOIL’s stock at less than INR 192 per share.

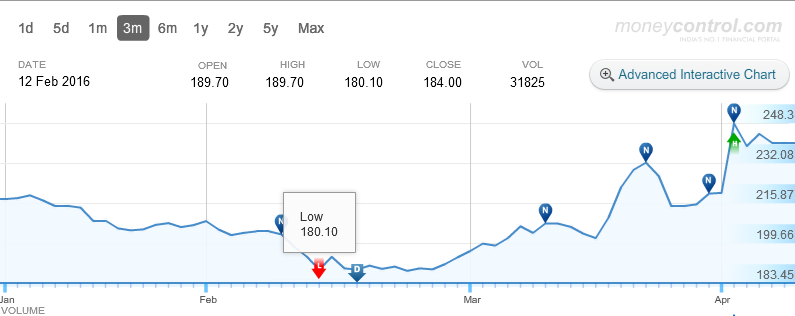

On 12th Feb 2016, MOIL stock was available for INR 180 per share

Disclosure - Not invested in MOIL, This post should be treated for educational purpose only.