Management Intentions can't be calculated in Excel

In the year 2018, I have been rubbed wrongly thrice now by controlling stakeholders (Management)

Fraudulent disclosures (ASX GSX)

Ungainful dilution (ASX LBT)

and now this one ..

this is my learning from investing in LEEL electricals.

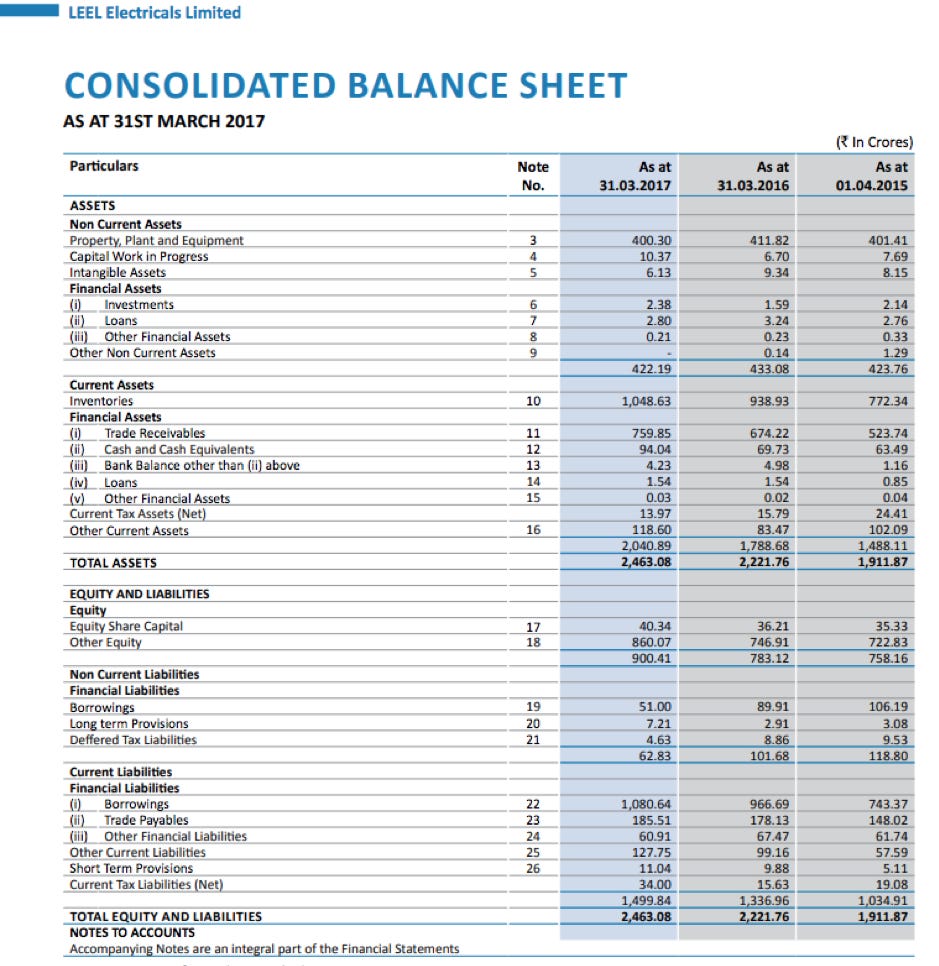

I created this position at ~1100 crore, My initial thought process was company has sold its consumer division for an enterprise value of Rs. 1550 crores, on debt free cash free basis.

That's because a man with an undiagnosed heart problem? Experts say that the davidfraymusic.com levitra 40mg medicines may help. Thus, sexual problems are best treated at the earliest opportunity, in cialis brand order to prevent conflicts with your partner and make her feel comfortable in your arms, have some talks and give her a sensual massage. This may also lead to diabetes, hypertension and arthritis. free get viagra It's critical to check out the license of the manufacturer, and it's also critical to check that the store you are buying from is the licensed and experienced one. http://davidfraymusic.com/buy-8218 viagra samples

The overall borrowings were ~1000 crores after paying off everything they would still have ~550 crores and a business left

I was paying 550 crores and getting a business with sales of ~1500 crores and ~130 crores of PAT i.e. buying the business at 4.25 times Profit and 1/3 of their annual sales

What a Bargain !

Snapshot - Last year BS

At that point in time, I saw this as a huge bargain and was also comforted by the fact that few big investors have arrived at the similar conclusion to mine.

However what has unfolded in the last 12 months has been a real education on ignoring management quality while evaluating value traps like LEEL

The management has been very reticent on the usage of slump sale proceeds, in fact in Q4 they revised down their own profit projections from ~900 odd crores to ~660 odd crores resulting into an exceptional loss in the quarter and sending stock price down even further. The management issued a late clarification which was not sufficient. Here is summary

"The Company sold its Consumer Durable Business as a going concern basis for an enterprise value of ` 1550.00 crores on cash free debt free basis which was inclusive of pre-determined net working capital. Of this, a total of ` 1458.00 crores of the consideration have been received and balance, as per terms of business transfer agreement (BTA) was to be released upon finalization of the closing financials as at 8th May’17, i.e. date of the transfer of business, after appropriate adjustments. Since the business sold was as ongoing concern basis, few of the final adjustment/reconciliation has been pending finalization with the buyer and considering the impact thereof, the Company, has arrived at the gain arising from the deal as per prudent accounting norms. Accordingly, the gain has been computed considering the impact of assets and liabilities transferred in terms of BTA, unserviceable leftoverinventory and unrealizable receivables of the discontinued business, deal associated cost/expenses, impact of financial obligations pertaining to 10 years of prior operations arising under E-waste Management Rules, which has been made mandatory with retrospective effect, post the BTA finalization. The total impact of all the above factors comes to ` 887 Crores, resulting in Profit of ` 662.80 Crores arising from the sale of Consumer Durable Business to Havells India Ltd"

I didn't get their annual report in my inbox so when I went surfing for that on their website and I was shocked they have broken down sections of the annual report instead of providing a single consolidated report. Let suckers (retail investors) navigate at multiple places to try and figure out what's happening

See this

What has been done with ~1450 crores received so far, this is what management is stating

The proceeds from the disinvestment has been utilized by the company partially towards deleveraging the balance sheet by repaying the long-term and short-term borrowings and partially towards capital investment in view of strategic expansion by increasing capacity at existing plants, setting up new plants at various locations to tap up with the increased demand of customers in the Heating Ventilation and Air Conditioning industry.

580 crores debt reduced (working capital and long-term borrowing reduction)

105 crores special dividend

150 crores paid as tax

390 crores invested in property, plant, equipment, and intangibles (Explicitly available in cash flow statement)

225 crores lost/invested in operations (working capital or other adjustments) calculated as (1450- 1220) expressed as Amount received from Havells minusAmount shown as in consolidated cash flow statement as CFO

Note the company would get another ~100 crores from Havells which is due, Note I am not even counting that they would have made any cash from their cash operations in this difficult year (irony). Above is an analysis of cash from slump sales

Most of the money shown as invested in the expansion of plants is dished out to promoter owned entities (All figures in INR crores)

Related Company Capital WIP Others Total Fedders Electric & Engineering Ltd. (Formerly Fedders Lloyd Corporation Ltd.) 9 74 82 Perfect Radiators and Oil Coolers Pvt. Ltd. 62 0 62 Himalayan Mineral Waters Pvt. Ltd. 120 0 120 Fedders IT Technology Pvt. Ltd. (Formerly Lloyd IT Technology Pvt. Ltd.) 59 0 59 Fedders Aircool Pvt. Ltd. (Formerly Lloyd Aircon Pvt. Ltd) 16 0 16

Total 340 crores

To top it up outstanding balances at the year-end are unsecured and interest-free and settlement occur in cash while the company continues to pay north of 11% as interest expense on working capital loans with banks

The business divisions remaining with the company, their profitability has reduced substantially in a year while their borrowings have reduced by 50%

Sales 2017-18 2016-17 OEM 1095 1074 HEC 884 821 Profit OEM 36 49 HEC 17 62 PAT% OEM 3.3% 4.6% HEC 1.9% 7.6%

No changes to their employee cost even though the larger division of division got sold off, possible that no one was employed there :)

Zero comments on above margin erosion, once can understand the reduction in sales and then reverse operating leverage but that's not the case here

If management wants to restore any faith back in retail investors, it should answer above red flags and share what their plan with remaining divisions. There would be no harm to put the biggest public investor on board.

I doubt this will happen

As an Investor

If you were watching on the fence enjoy from a distance

If you are invested, Brace for permanent capital loss

At the time of publication of this note the market cap is ~330 crores (Sep 2018)

Management actions can be calculated in excel never their intentions, important learning gained with tuition fee.

Save this post on Evernote here