Kitex Garments - Earnings Power Updated

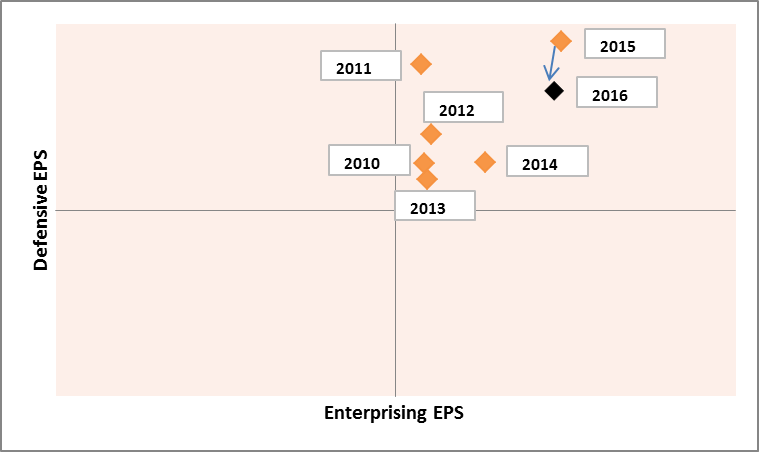

Another year gone, Got my hands on Kitex Annual report and updated the Earnings Power Box. Lets look at how the company has fared

Before you proceed, its better you go through this post so that you are familiar with terms used below

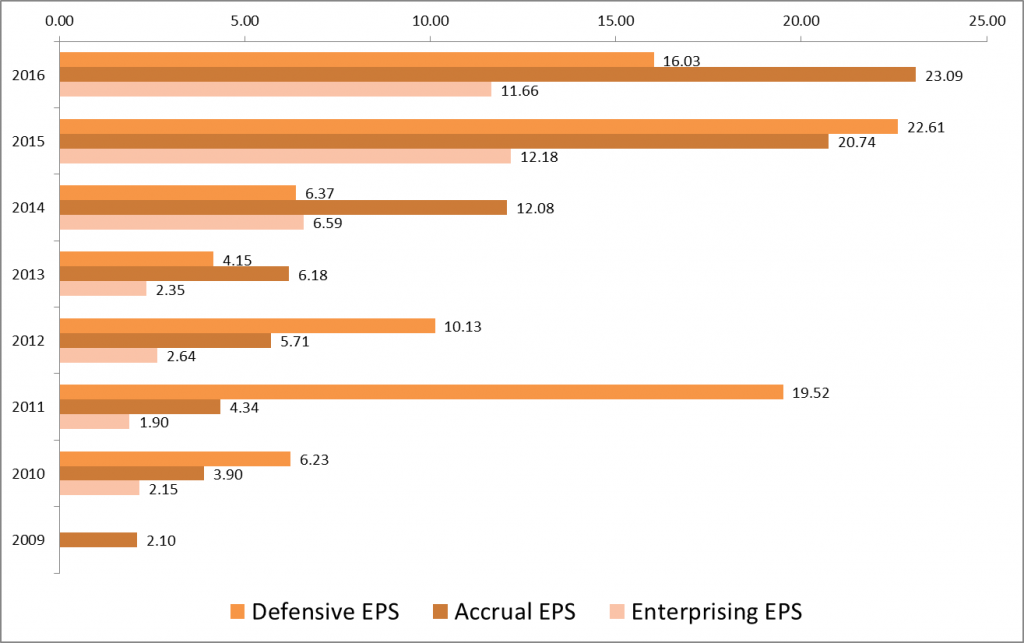

The Accrual EPS (or reported EPS) saw an increase of 11% while the Defensive EPS declined by 30% and Enterprising EPS declined by 4%

What led to such a sharp decline in Defensive EPS ?

While the company’s purchase of fixed assets reduced by 80% (INR 7.37 Cr Vs INR 31.7 Cr) the working capital increased by INR 47.7 Cr (Last two years they had reduced their working capex). Most of the additional investment is due to the fact that Accounts receivable has increased by 50% and current liabilities have not kept pace with it. Not sure if company had a significant change in credit policies.

Even with a decline in Defensive EPS, the company continues to be in wealth maximisation quadrant

Some other titbits of from Annual report which I found interesting

Last year annual report claimed that there capacity was 5.5 lakhs pieces of infant wear per day, this year it’s called out as 2.7 lakhs pieces, Clearly last year figures included KCL’s numbers.

For new players to get into preferred list of big infant wear labels is extremely difficult as there are various product safety certifications

Rampant buying and selling by brokerage house “ACUMEN CAPITAL MARKET (INDIA) LTD” now you why we have swings in mid-caps and small caps :)

No update of merger with KCL ltd

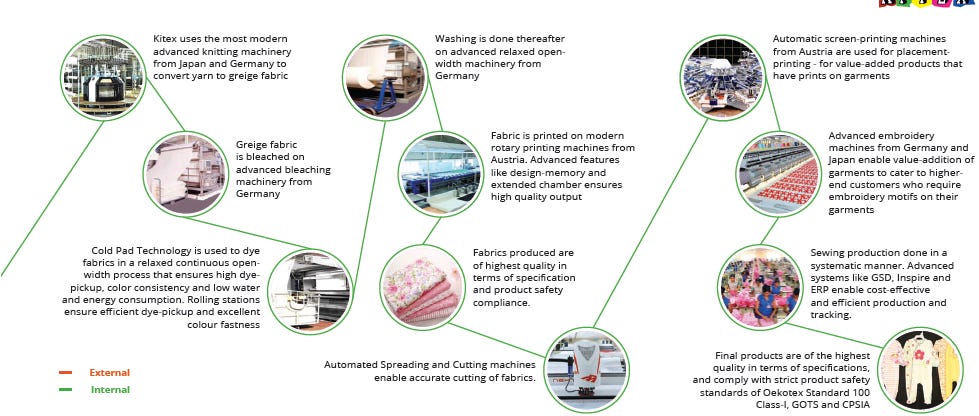

Details around factory automation were interesting and finally

A very good overview of Kitex Value chain

What did you like / dislike in the report ? Share below in comments