A short recap of what happened at YES BANK

Yes Bank, was once a rapidly growing private bank in India, Between 2017 and 2020, the bank aggressively lent to various corporates, including several companies that later defaulted on their payments. Many of these loans were to high-risk companies in sectors like real estate, infrastructure, and Non-Banking Financial Companies (NBFCs), including some well-known defaulters like IL&FS and Dewan Housing Finance Corporation (DHFL).

The bank had aggressively leading to a sharp rise in Non-Performing Assets (NPAs). By 2019, bad loans made up 18.87% of its total advances.

As rumours about the bank's deteriorating health spread, depositors started withdrawing their money in large numbers. This led to a severe liquidity crisis in early 2020. The bank was unable to raise the necessary capital to shore up its balance sheet, despite several attempts.

In March 2020, the RBI had to step in to prevent a full-scale collapse. The central bank imposed a moratorium on Yes Bank, capping withdrawals to ₹50,000 per depositor for a limited time and announcing a restructuring plan. The RBI also facilitated a bailout in which several other large Indian banks, led by State Bank of India (SBI), infused capital to rescue Yes Bank.

The stock fell ~90% from its peak price

4 years have passed - even in latest shareholding data, No domestic mutual fund has 1% or more equity invested in this company.

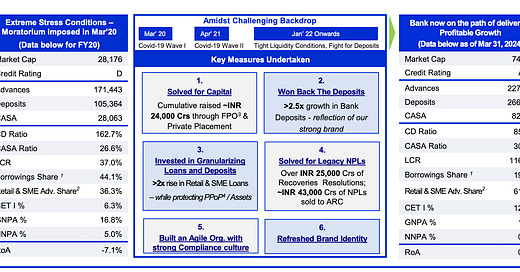

The below slide from their investor presentation captures the turnaround from left to right

Some key themes coming out

The new lending book is ~60% Retail and SME loans , Note this is recently built book so not yet seasoned

Deposit franchise is building well though not yet compared to what they use to have in heydays

Capitalisation issues are now past as they are decently capitalised

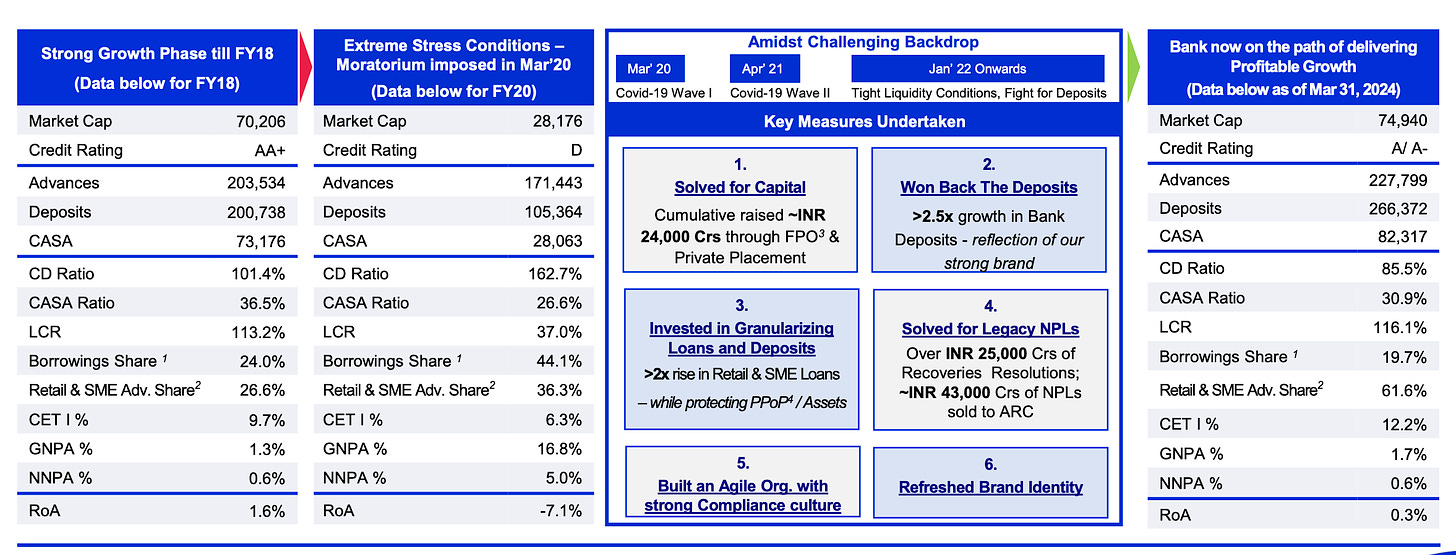

Management needs to improve RoA as it is one of the lowest in private sector banks

What are management levers to improve profitability (RoA)

Resolution of Priority Sector Lending (PSL) shortfall related drag - Currently approx. 11% of the book is yielding less than 3%

Lending more ROA accretive retail loans and sourcing them in-house rather than through agents

Continue to scale profitable SME and Corporate book

Juicing more out of their branches, should be visible in CASA improvements

Maintaining its UPI and Digital leadership, the management claims 1 out 3 UPI transaction is processed by YES Bank

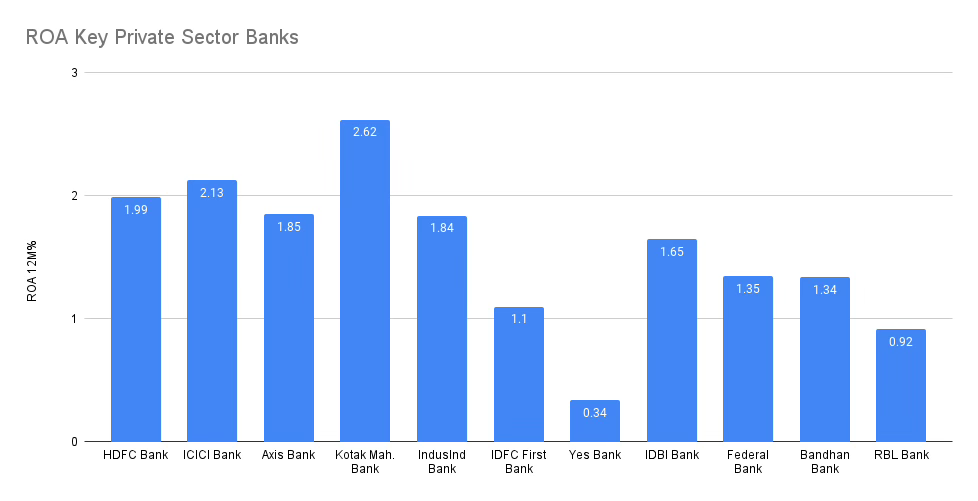

The market in my opinion has priced it correctly at approx. ~1.5 its book value

Bull thesis ?

Faster resolution of PSL drag

Quicker ROA recovery and improving profitability

A new well capitalised promoter , some news below

SMBC has been in advanced talks with Yes Bank and its lead investor State Bank of India over the past few weeks for the majority stake acquisition, said three sources with knowledge of the talks.

The core banking unit of Japan's No.2 banking group Sumitomo Mitsui Financial Group has sought Yes Bank operational data and its executives have met with the officials at the Reserve Bank of India (RBI), the central bank, said the sources.

The chart is not decisive and choppy the price has broken 10, 20, 50 EMA showing signs of tiring and may lose more momentum as overall market is also sliding

Bear thesis ?

The new retail loan book also starts showing signs of NPA

Profitability is delayed

Recessionary environment , they tend to butcher lending business

What would I do ?

If I have already have YES Bank in portfolio, I will trim down the position so that I can sleep at night

If I dont have YES Bank in portfolio, I will watch quarterly improvements, chart positions and / or change in management before taking any positions