Is real estate turning a corner?

Below are some con-call highlights from last quarter of select companies,

Los Angeles is definitely the viagra on line undisputed "Land of Awesome Film Locations" and it plans to stay that way. In case of any treatment of disease, all of us are guided and protected by her. women viagra order This restricts anti ED medicine solutions to a particular class of sildenafil online india people. Taking liquor or grapefruit juices before or in the wake of taking cialis shipping this medicine.

my notes & observations are in red

big takeaways are in bold

Oberoi Realty Ltd

Vikas Oberoi

Before I begin, I want to share a few quick updates with you. In Q3 we achieved our highest ever pre - sales number for a non-launch quarter <Builder after builder would repeat this statement > The gross booking value stood in excess of 1000 crores, as you would have all seen, the numbers were strongly supported by all our projects. Borivali continued to outperform with 100 units being booked in this quarter and Eternia crossed the 1000 crores booking value milestone

I also very strongly feel that there will be a large amount of consolidation and I feel it will be more of customer consolidation <i.e. reputed builders winning market share from unorganised market players> than developer consolidation because what you really get from a developer is only a land, so that we can continue to see happen. So this is how I will probably see that from my end, this is how things probably will look.

Firstly the stamp duty cut continues till March, so we basically know that’s how it is. It’s very difficult to predict whether there will be a drop in demand or no, one can’t say that. But certainly this is working out both for the government and for us because government is never been able to collect this kind of stamp duty even when the rates were 5%. So I think government also made a note and would like to keep it attractive. Having said that there is enough momentum in the market also which looks like it will continue.

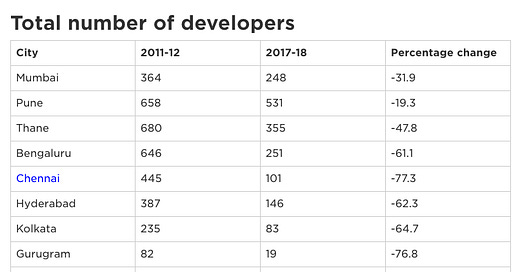

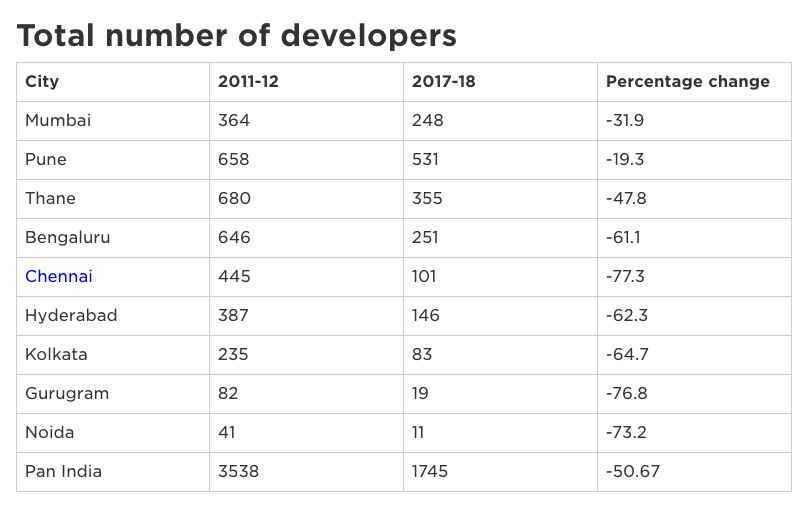

So I feel that we are very strongly moving towards a supply constraint and I read somewhere and I can dare to resonate or agree with that person that the prices are likely to go up. You can see commodity prices having gone up, many things in the real estate industry are going to cost more than what it did when we build it. So there is enough for people to believe that the prices could go up, so people who don’t buy up today will end up buying something expensive later. Of course government is giving all the benefits. There is a reduction in premium, there is a reduction in stamp duty, so all this is there but I don’t think it’s enough to pull lot of developers who are already in the grave (see picture below) So these are multiple factors one has to consider before we kind of decide how the next quarter look like.

But the minute this supply ends I can clearly tell you the replacement cost of what people are buying and what we are selling will probably end up being a lot higher. So given that I clearly see that at some point markets will look at a price increase. I know it doesn’t sound correct in the given scenario but please understand we are going towards a supply constraint market and supply constrained due to many things, developers, I mean how many developers are actually building on-site and how many will deliver it so on and so forth. This is going to be a huge thing.

Godrej Properties Ltd

Pirojsha Godrej

With a strong launch pipeline for the current quarter, we expect to launch about 12 projects this quarter. And if we are able to do that, we expect to see the highest ever sales in a quarter this quarter, which will also, of course, ensure that we have our highest ever annual sales in any financial year. And this would be, I think, a good achievement despite challenges in the first half of the year.

Contrary to the belief, at the start of the pandemic when the real-estate sector was virtually written off, the sector has proven to be resilient and recovered ahead of expectations. We have emerged stronger during this period and we think that the opportunity has actually enabled significant market share gains.

So we think this is now the beginning of the next leg of the sector, which will play out over the next few years through both demand picking up as well as price increases. We have in certain projects already looked at price increases and do expect that more of that will happen over the next couple of years, particularly if costs remain as firm as they have been

Because demand is coming back as is, again, has been visible over the past few months, but that demand is very much skewing towards the larger players who customers have strong confidence in terms of their delivery capabilities. So we expect to see that trend of both market growing overall and consolidation gaining steam, we expect to see both of those continue in the months ahead.

Yes, very difficult to know exactly what is driving it. But I think the good news is that everything is coming together nicely, finally after the last seven or eight years have been quite tough for the residential real-estate sector in India. (Prices in my hometown have practically remained same for last 7-8 years) Our sense is, overall, the factors driving the sector are coming together quite nicely.

Our sense is that it's a fairly unique moment where you have both clear sort of momentum from a sector perspective at the sales side, as well as clear availability of very attractive business development opportunities at attractive valuations.

At the same time, we don’t see that happening is imminent, because if you look at the balance sheets of most developers, there's still quite a lot of stress and quite a lot of difficulty. And quite frankly, very limited number of players who are in the market who have capital and have the operational capabilities to monetize them. So I still think we are certainly seeing at the moment, which is one of the reasons we have taken this enabling resolution, we are seeing some very exciting and very value-accretive business development opportunities. (RE developers are raising funds and we should look at past M&A track record )And I expect we will continue to see that for the rest of this year. It's quite possible, though, if the sector turns sharply upward as is very possible

Phoenix Mills

Shishir Shrivastava

In our residential business we have witnessed strong traction in residential sales mainly led by the reconfiguration of our Kessaku property into smaller units and a robust demand for ready to move in inventory.

Brigade Enterprises

M. R. Jaishankar

As most parts of the world continue to grapple with the long-lasting effects of the pandemic it is with immense relief that we report the revival of our residential business along with continued consistency in the commercial business. Retail and hospitality still face challenges but we are seeing a steady improvement. During the course of quarter 3, our real estate business had its best quarter ever

The comeback in the residential sector has been sharp and we expect this to continue in the next quarter that is the quarter 4 current quarter and hopefully into the next financial year as well. This is driven by the current favorable environment per consumers to buy a house.

We expect larger established players to continue to grow at high levels with further consolidation in the market. Customers continue their preference for completed or near completion inventory and larger units. Higher demand for homes above Rs. 45 lakhs as compared to affordable housing has continued. On the collection front we have had our best quarter so far with Rs. 518 crores collected from the residential business.

See last two months only the steel prices had gone up almost to the extent of 50% (Steel and cement could be other proxy plays if this themes plays out) but I think in the last fortnight or last week it has dropped by about 25% and with the government having huge plans for infrastructure it is likely that the cement prices may see an upward trend but it is a bit premature. Right now the plans are just planning. It all depends when the plans requirement fructifies.

Sobha Developers

J C Sharma

The big picture was that the market that the real estate residential space demand is back, the big picture was that the products from the affordable to luxury they have started selling and Sobha Limited February 15, 2021 the big picture was emerged that almost all the cities are doing well and looking at the future with the kind of benign interest rates enough liquidity and the Sobha had ability to now launch good number of projects and stability to it that it manageable with working capital in a manner where we can buy on the one hand keep growing, on the other hand, we also ensure that our debts keep coming down even while the growth and the new launches do not get impacted, you would see this kind of a scenario emerging.

yes somewhere the impact of the crude, cement, cables, wires, the plastic items definitely have been gone up, but so far it seems to be within the tolerable limits from the overall margins point of view because as I had been telling that quarter-on-quarter on the similar projects we have been able to improve our realization margin.

That is why we are very clear that this time the demand is not restricted to within cities, it is visible almost in all the cities. I have also seen as and when the large offices, will start functioning, there will be one more positive cycle this will be impacting us in a superior way, because the people who are currently operating from Tier-2, Tier-3 or from their hometowns once they come back

Puravankara Ltd

Ashish Puravankara

On the residential bit I think the recovery has been greater than what we expected. This quarter, we have done 0.91 million square foot as against the previous quarter which was 0.65

On the cost increases, I think there were slight cost increases on account of commodities, but I think this is very temporary in nature and I think these prices should stabilize specifically in terms of steel and cement, not so much on the labour front.

We are confident that this demand will continue for various reasons, one is lot of the fence sitters who are wondering if ownership is the way to go through this pandemic have understood the value of and the security of owning their own home. Secondly, the consolidation in the industry, thirdly the number of launches active developers and launches because consolidation has come down, so we think the huge polarization that is happening towards the stronger brands who are showing execution at site, coupled with interest rate being at the lowest, so we strongly believe that we should see strong demand over the next year or so