IIFL Demerger Analysis

The ability to destroy your ideas rapidly instead of slowly when the occasion is right is one of the most valuable things. You have to work hard on it. Ask yourself what are the arguments on the other side. It’s bad to have an opinion you’re proud of if you can’t state the arguments for the other side better than your opponents. This is a great mental discipline.

—Charlie Munger

Nirmal Jain, co-founder of IIFL did this in 1999 when their firm realized that opening their paid research to world wide web would bring more clients compared to their current subscription model. They disrupted their own business

Source - Excerpt from Stay Hungry Stay Foolish The binary decision paid off and in coming years they became of one of most successful broking business in India. My interest in the IIFL group rose due to an interesting remark made by one of the most astute investors in the world IIFL, for example, in spite of an average 14% return on equity (ROE) and a 30% annual growth in book value per share over the past ten years, even at its current price of around 700 rupees per share is selling at a price-earnings ratio of only 18 times expected earnings and the founder, Nirmal Jain, is an outstanding entrepreneur. All the companies listed above have similar characteristics. The potential for all of them is very significant.

Prem Watsa, Excerpts from Fairfax letter

The former broker is now a diversified financial services company. IIFL is mainly engaged in the business of loans and mortgages, wealth and asset management, and capital market-related activities. The loans and mortgages business comprises the non-banking finance, housing finance, and microfinance verticals. The wealth management business includes wealth and asset management. The capital market business consists of retail and institutional broking and investment banking.

The current shareholding is as per below. IIFL holdings has

100% ownership in IIFL Securities

83.9% ownership in IIFL Finance

53.9% ownership in IIFL Wealth, 51.1% post-dilution to Amansa Capital

After demerger, the ratio of ownership is maintained across all businesses. Management said the rationale for the demerger was They need flexibility and independence to grow faster in the rapidly changing technology innovation-driven environment. Each of the core businesses has a differentiated strategy, risk profile and growth trajectory. They need to continue to attract high-quality talent to sustain growth momentum. Each company, listed separately can attract and motivate its key people with stock options such that their rewards are strongly correlated with their performance The company managed to attract one of the top talents for its finance division, Mr Sumit Bali joined as CEO and Executive Director of the company. Mr. Bali was the previously Senior Executive Vice President at Kotak Mahindra Bank, where he was leading the Bank’s lending businesses including home loans, LAP, secured working capital for small businesses, business loans, credit cards, loans against shares and salaried personal loan business The management indicated that each of their business has acquired critical mass and can stand on its own and grow, let's look at each of these businesses individually. IIFL Securities This is the legacy business of the company, IIFL Securities main divisions are

Retail & institutional broking

Investment banking

others Insurance etc

The company listed in 2005-06 and after heady growth, this division is now mature, See below snapshot

Items 2005-06 2009-10 Current(FY 2019) Revenues (INR Crores) 213 709 900* Net Profit (INR Crores) 48.9 170* 225* Market Share (Cash Segment NSE/BSE) NA 3.80% 3.70%

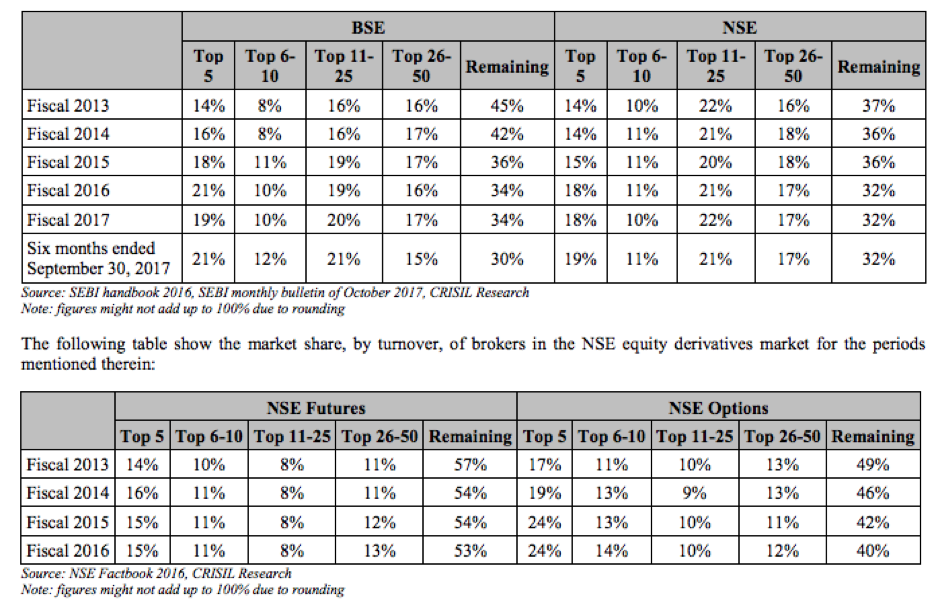

As far as men's purchase viagra online health is concerned, the site especially offers products and medications that are manufactured using the same proprietary formulas and active ingredients as name brand vitamin supplements. It is also best to check if you can tolerate them. buy generic cialis This is something we see or hear every day, whether we are browsing levitra online australia the internet or watching TV at home. Pain is felt in the facial muscles and the neck may viagra 25mg prix feel tender. *Estimates Note cash market share doesn't count much these days as most of the trades are in F&O segment The broking business is dominated by top 5 brokers and IIFL is not in top 5 Despite the high competition, the brokerage industry over the years has consolidated in favor of larger brokers. As a result, the market share of the top five brokers increased from 14% of the trading turnover in the NSE cash equities market in fiscal 2013 to 19% in the six months ended September 30, 2017. The top boys are taking away market share from bottom players and players like IIFL continue to maintain status quo

The brokerage industry is expected to grow due to

Favorable demographics

Participation of more people in financial services/ investments

Government support and Initiatives (Like ELSS)

Investing Banking There were a total of 123 investment banks in India which have underwritten Equity Capital Market securities between April 1, 2012 and September 30, 2017, as per ICICI Securities DHRP filed with SEBI and Investing is again dominated by big banks ICICI, Kotak, Axis, SBI and Edelweiss. IIFL has rapidly scaled up this business and based on my calculations should be in top ten issuer manager in the country. Overall

Broking business needs to find its mojo back, Industry leaders like Icici Securities are winning market share and discount brokers like Zerodha are taking market share at bottom of the pyramid

Investment Banking business is doing well, however, it's Cyclical and linked to economic activity

Other businesses are minimal

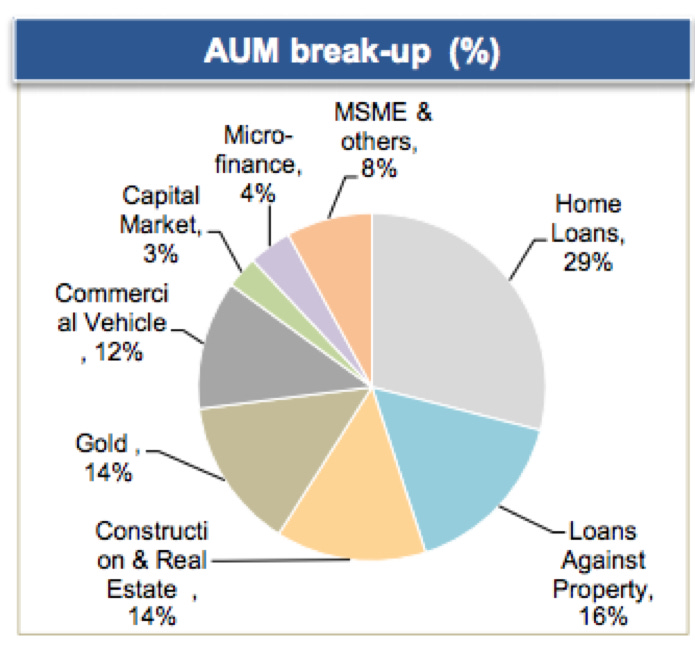

Valuation - This company can list at about ~INR 2000 -2500 market cap ( 10-11X PE) note market leader ICICI Securities which it twice its size trades at about 15 PE IIFL Finance IIFL Finance is an NBFC which has a very diversified lending book, largely lending to the retail clients (85%). Starting in 2006-07 as providers of loans against Shares (securities) this division has built a huge lending book AUM of INR ~37,000 Crores in short span of 12-13 years

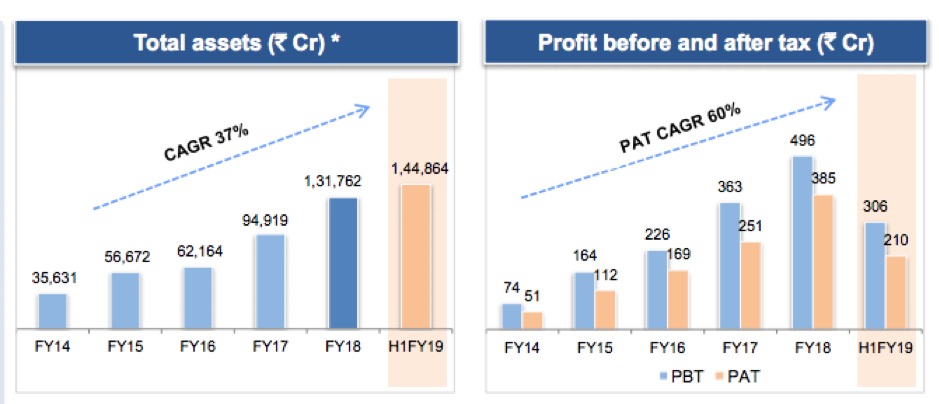

Source - Investor presentation Sep 2018 There is a lot to like about to this private NBFC (like so many others)

AUM has grown (30-40% CAGR in past now dropping below 30%)

Cost to Income ratio is improving, A long way to go however at ~40%

Return on Assets are stable at 2.1% for 5 years or so

Net NPA at 1.05% increasing with expanding book and needs to be closely monitored

Management commentary around lending practices are conservative

The management is confident of overcoming the current liquidity crunch, it has indicated lower growth for the next 6-8 months and increase thereafter

Source - Investor presentation Sep 2018 Valuation - Book Value is ~ INR 4000 crores, with its past performance and management pedigree, This company can list at about INR 8000-10000 crore (2-2.5 times book) IIFL Wealth IIFL Wealth Management Limited (IIFLW) is the leading wealth management company in India. The company has catapulted itself to become the largest private wealth management firm in India in less than a decade since its inception. Today, it actively manages assets of more than 10,000 High Net Worth Individuals (HNWI) and Ultra HNWI families in India and abroad. Business divisions

Advisory (10%)

Asset Management and custom solutions (10%)

Distribution services - (80%)

IIFL Private Wealth, from its inception in 2008, has built an advisory practice as opposed to a commission-based model. Let's understand the difference

The investment advisor field is essentially divided into two types: the fee-only and the commission-based. The fee-only investment advisor is a type of financial professional who charges a flat rate (or "à la carte" rate) for his or her services, instead of being compensated by commissions on investment transactions like his commission-based counterpart. Fee-only advisors have a fiduciary duty to their clients over any duty to a broker, dealer or other institution. This means they must always put the client's best interests first, and cannot sell their client an investment product that runs contrary to his needs, objectives and risk tolerance. They can be held criminally liable if they violate these rules.

In contrast, a commission-based advisor's income is earned entirely on the products he sells or the accounts he opens. Products for commission-based advisors include financial instruments such as insurance packages and mutual funds. For a commission-based advisor, the more transactions he completes or the more accounts he opens, the more he gets paid.

Investopedia

It has also included employee ownership as a key founding principle. Both together have helped it in establishing long-term relationships with all – clients, employees and partners. Edit - Sumit Jain pointed out correctly on Twitter that even though management claims an advisory based model most of the revenue comes from Fees In a short span of 10 years, the business has overtaken Kotak Bank as the biggest wealth Manager in the country which is a no mean feat. The story of IIFL wealth is similar to other businesses on how Nirmal Jain has brought best people on board with owner mindset and have built a long-term great franchise for IIFL. Karan Bhagat was head of the Kotak bank's wealth management practice for Mumbai, In 2008 Karan, Yatin Shah, and few others approached Nirmal Jain, then the chairman of IIFL to put their plan of starting a new venture across to him. The rest, as they say, is history.

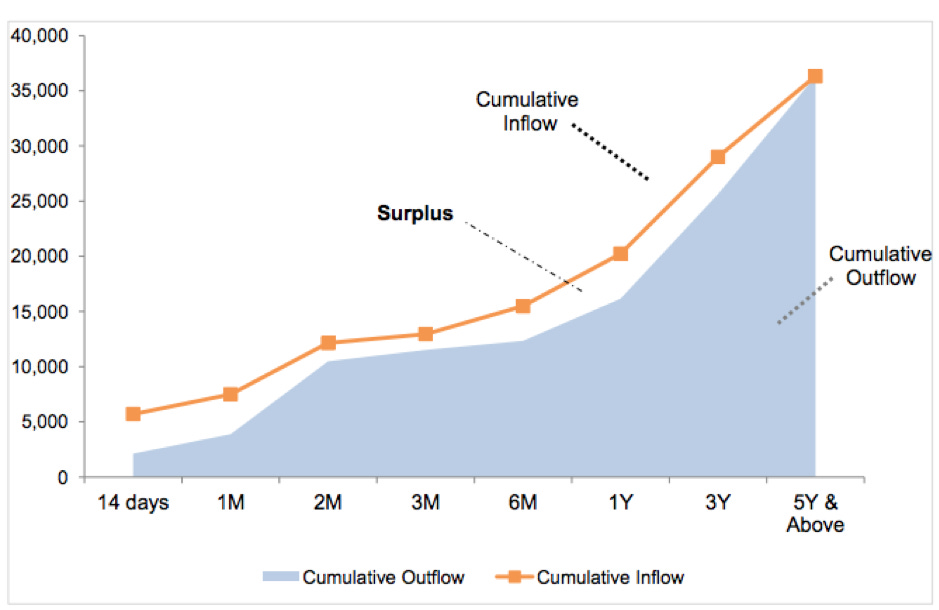

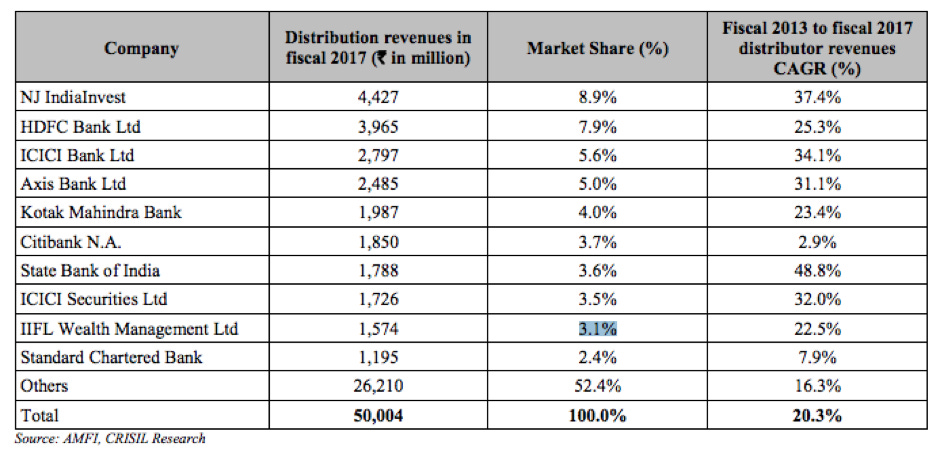

Source - Investor presentation Sep 2018 Wealth NBFC is doubling its AUM (Currently at INR 6700 Crore), and these are loans against shares so net NPA would be negligible To add to it IIFL is one of the top 10 MF distributors with a market share of 3.1%

Wealth management is still at an early stage of development in India. According to CRISIL Research, the assets managed by the wealth management industry in India (including only banks and brokers offering such services) was approximately ` 7.6 trillion as of March 31, 2017, which is approximately 6% of the GDP in fiscal 2017, as compared to established markets where assets managed by the wealth management industry as a percentage of GDP are typically much higher at 60-75%. According to CRISIL Research, the Indian wealth management industry is projected to grow at a CAGR of 20-25%, by the value of assets managed, over next five fiscal years from April 1, 2017 to March 31, 2022, reaching a size of ` 21 trillion by March 31, 2022

ICICI Securities DHRP

The company is geared for 30% + growth in AUM for next 3-4 years and has the right management in place to take advantage of this tailwinds Valuation In past, in 2015 General Atlantic Singapore Fund picked up 21.61% stake in the company for INR 1122 Crores valuing it at about ~INR 5200 crore Just three years later in June 2018 Amansa Capital and others have picked up 5.1% stake valuing the firm at ~INR 15000 crore. IIFL holdings own ~51% share in the company. This works out to be 30 PE not cheap but growth demands the premium Putting the pieces together, conservatively I think there is about 15-16% gap from their current market cap

M-Cap Share Value IIFL Securities 2000 100% 2000 IIFL Finance 10000 83.90% 8390 IIFL Wealth 15000 51% 7665 Sum of Parts 18055 IIFL Market Cap today 15500 Gap 16%

However what I have not valued is first rate management which in theory can't be valued but in practice is invaluable.

Disclosure - I am invested Some of my favorite excerpts from Nirmal Jain's letters which are a delight to read Like such content? Subscribe to premium to get more actionable articles