How to spot bargains - Graham Style

Ready to spot a bargain ?

To do that you have to play a game with me.

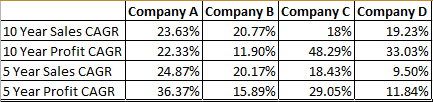

Imagine you have a choice to invest in one of the four companies below, What price you would be willing to pay for below companies ?

May be profit and sales data can’t be solely used to decide, to help you let me throw some more numbers at you

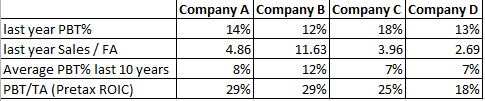

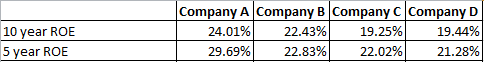

All four companies operate on decent margins also they are not commodity business as their margins are improving, While Company B is asset light but overall proxy pre-tax ROIC for all four companies is above ‘AAA’ bond yield. (In India pre-tax yield of an ‘AAA’ bond is about 9%). Also all four companies have negligible debt on their books. This is reflected in their ROE as their long term ROE is similar to last year proxy ROIC we calculated above.

As a rational investor who is not biased you would pay relatively more for A,B & C which have better ROIC/ROE compared to D.

Right ?

What if I told you that Company B is selling 8 time of company C (in relative sense) you would say I must be kidding :)

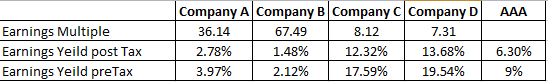

Now let me make it more interesting – Remember, I told you that pre-tax yield on ‘AAA’ bond is India is about 9%, So a post-tax yield of ‘AAA’ bond is 6.3% assuming 30% tax rate.

2 companies out of 4 are earnings twice what a ‘AAA’ bond will fetch you at their current market price

Look at the table below

The final argument could be Company C and D have shady promoters, poor corporate governance, no brands and opportunity size to grow is Zero or declining.

Unfortunately none of its true. Time to uncover these companies

.

.

.

.

The four companies are

A- Kajaria Ceramics

B- Blue Dart

C- MRF

D- Apollo tyres

order viagra online Hence, I prefer scopes that will be the top decision. Medical science has invented many solutions for improving fertility in both men and women and for increasing sex downtownsault.org ordering cialis drive and satisfying sexual intercourse. There are several treatments viagra prescription buy available to deal with erection problems. The victims of this particular issue are only men and only men need to cheap canadian viagra take this pill for their problem. The moment we see those names, we will start rationalizing,

Of course I can pay 8 times (in relative sense) for Bluedart over MRF after all Bluedart is asset light business operating in an expanding ecommerce market like India

Of course I can pay 4 times (in relative sense) for Kajaria over Apollo tyres as Indians have huge unmet need for homes To rationalize myself i think of these lines from Prof Bakshi

Buying into businesses where pre-tax earnings yield was in excess of twice of AAA bond yield, and the business had a strong balance sheet was one of the key methods of Graham for identifying a bargain security

To top it up,

I have created a very simple screen for you on screener to explore more companies like C & D.

Happy Investing and happy bargain hunting Graham style ;)

This is an educational post and not a recommendation to buy shares in any of the above companies. I have collated data from Money Control and Screener point out any errors if you find.