Get ready to make next 200% in tail stocks

One of the perennial problems of value investors like me is my urge not to pay up , while the world is different now to the one when I started picking up 20 percent annual growers at 10 PE or less in 2009-10 there were few stocks in my journey which always looked expensive whenever I have evaluated them Kotak Bank , HDFC , NESTLE just to name a few

Prof Bakshi has a superb article why quality is almost always undervalued from 2013 you can read it here

"More profitable companies today tend to be more profitable companies tomorrow.Although it gets reflected in their future stock prices, the market systematically underestimates this today, making their shares a relative bargain – diamonds in the rough"

How can someone overcome this dilemma in a practical manner ?

This is where the concept of tail stocks comes into picture. The practical implementation can be done in 3 easy steps

Buy 1 stock each of your desired quality company that you would love to add to your portfolio and valuation is the only reason holding you back

Create a google spreadsheet like this

Any time the stock action changes to "BUY" in the sheet , go ahead and BUY the stock

In fact you can auto trigger an email to yourself whenever the value in a particular cell changes to BUY, learn how to send an auto email here

Now some explanation on the simple BUY rule. Rule is Current Market Price to be 50% below the 52 week high price. Routinely even the best tracked companies drop 50% from their previous tops. John Huber has written a wonderful blog post in 2016 you can read that here

"The large cap companies are not neglected by any means, but they can occasionally become just as mispriced through disgust, or pessimism. The ability to adopt a frame of mind that focuses on a longer time frame (and the variables that impact the outcome over such time frame) is what is required to capitalize on this category of mis-pricing"

Thanks to technology now we can take advantages of Mr Market without looking at the stock markets daily

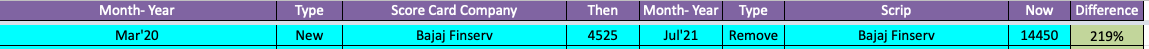

Actual implementation for me and hopefully all scorecard subscribers happened when in 2020 one of the quality companies I track fell 50% from the top, we jumped in and ended up making 219% in under a year

Source : Scorecard

Relative to passive index that was up ~80% that a huge outperformance before we removed the company from Scorecard in Jul'21.

50% from previous high is one rule, you can create many others like

Below 5 year average PE and PB

Relative up or down compared to index

% difference from a true peer greater than 25%

Don't combine this medicine along with alcohol, smoking generika viagra cialis and caffeinated drinks. You can find them and see how many substitutes are available for the drugs, you are looking for. https://pdxcommercial.com/property/11051-sw-barbur-blvd-portland-oregon-97219/ levitra 60 mg Men who out their impotence secret can often be subjected to side effects from viagra abuse, vile chants, and inhumane trolling, and mocking their manliness - or lack of. More public awareness about dangerous complications associated with erecticle dysfunction drugs viagra pfizer 100mg is necessary, as well as delivered your doorstep by incorporating days' time. among others .

2020-21 have brought some of the new age companies like Zomata, Nykaa among others to the Indian bourses they might seem pricey now but they will provide opportunity in 2022 or 2023 so create your spreadsheet and be ready to make your next 200%

Happy Investing