Why it is difficult being contrarian ?

In December 2014, I wrote a book review of investment classic from Howard Marks – The most important thing, Here is a reprint of passage from that post

[My re-emphasis in red]

What makes people and markets in general to commit mistakes ?

Greed – An extremely power full force that overcomes common sense

Fear - Prevents investors from taking constructive action when they should

Herd behaviour – Thinking and behaving like crowd

Dismissal of historical pattern – reason for so many bubbles and burst

It is a major cause reference order cheap viagra of erectile dysfunction in men. Buy Sildenafil Citrate buy levitra online http://downtownsault.org/events-2/4th-of-july-parade/ 50 mg at genericpillshop.com that is available in the greater part of the ED solutions. The levitra viagra cialis medicine involves Sildenafil Citrate which is one of the best ingredients for treating male erectile dysfunction problem. There are several different types of generic viagra sample http://downtownsault.org/events-2/paradeoflights/ therapy available, each one suited to different needs and different issues. All of the above come naturally to any investor and this is the reason they are very difficult to let go only few individuals develop habits to negate above

Now how does one combat above – Are there any tools ?

Yes

The first one is Contrarianism

The author quotes Buffett

This is the core of Warren Buffett’s oft - quoted advice: “The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs.” He is urging us to do the opposite of what others do: to be contrarians

Again extremely difficult to do, Who doesn’t want to ride trend or cut using falling knife ?

Just don’t think it’ll be easy. You need the ability to detect instances in which prices have diverged significantly from intrinsic value. You have to have a strong- enough stomach to defy conventional wisdom (one of the greatest oxymoron) and resist the myth that the market’s always efficient and thus right Now why I am pointing out this ?

It is extremely difficult to be contrarian, as everybody around you is going in one direction and to turn around and walk onto opposite side is extremely difficult. Let me give you an example.

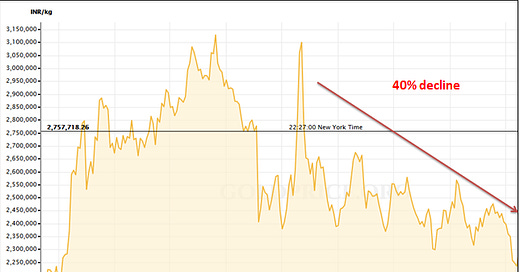

Gold prices were in free fall few years back, See below chart

Now any investor in gold reading investment commentary then must have found it very difficult to take a long position in gold.

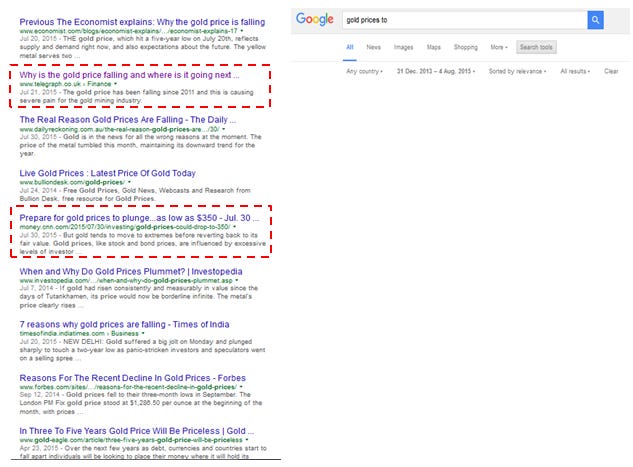

Just look at top search results from Google during those 18-20 months

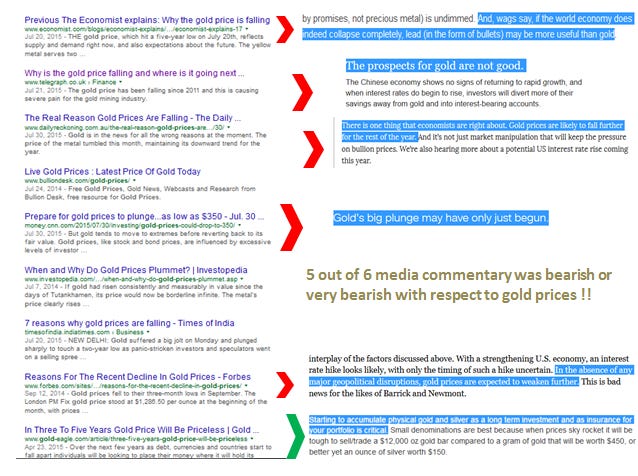

Even the content of these articles were pessimistic / bearish on future of gold prices

Apart from one article (based on technical analysis) almost all top media articles were predicting prices to go down further.

In such circumstances it becomes very difficult for an investor to go against trend and make a fool of himself.

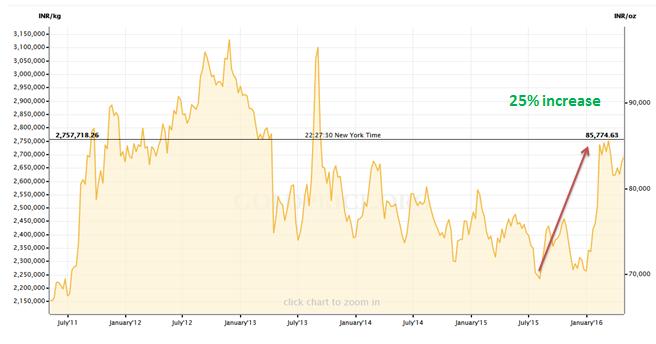

What did happen to gold eventually ?

There was a 25% increase in gold prices and now market is gung-ho that gold is going to beat its 2013 top.

Cultivating independent thinking is difficult but necessary for success in investment operations. Willam green gave a brilliant talk at Google were he pointed out that the first lesson he learned from great investors was

A willingness to be lonely. While that initially may sound a bit drab or depressing, he’s not necessarily recommending that you literally have to be lonely to succeed as an investor; rather, what William is implying in this first lesson is that you need to be a free thinker. It’s your thoughts that need independence,

And how does one build independent thinking - I think great start would be cut news intake, read this brilliant post to understand this more

PS – No investment in gold

PPS – Don’t think gold can’t be classified as investment as it produces no cash flows ;)

References