BSE - Heads I win, Tails I don't lose too much

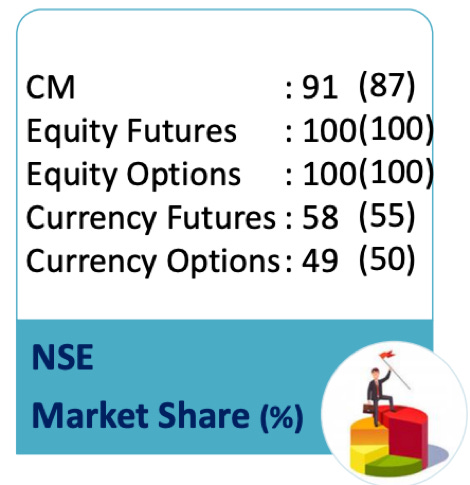

Established in 1875, BSE Ltd is the oldest stock exchange in Asia and operates the BSE exchange platform (formerly Bombay Stock Exchange). People often refer BSE as a duopoly with NSE being the other player however its a lopsided duopoly with NSE bossing the equity segment. Below is a snapshot of NSE dominance

Source - NSE Presentation

Not only NSE is dominant it is gaining market share due to its network effect.

How did an exchange so prevalent lost its Mojo?

CEO Ashish Chauhan has put it very aptly in his interview with Forbes

The BSE was late to the derivatives game. Typically, one is likely to trade equities at the same exchange where one trades derivatives. So a gap was created. The BSE had basically zero market share in derivatives, currencies, commodities… pretty much everything except a little bit of equities and some initial public offerings (IPOs). The technology wasn’t considered very good. People had pretty much written the BSE off. Why did the NSE become so big? Not on the back of the past but on the back of the new [offerings]. Derivatives played a big role in it.

So there were mainly five issues which the BSE had to work on—technology, people (talent), lack of new products, small distribution (it was primarily a Bombay exchange, so had to bring in members from outside), and our regulatory reputation was very bad

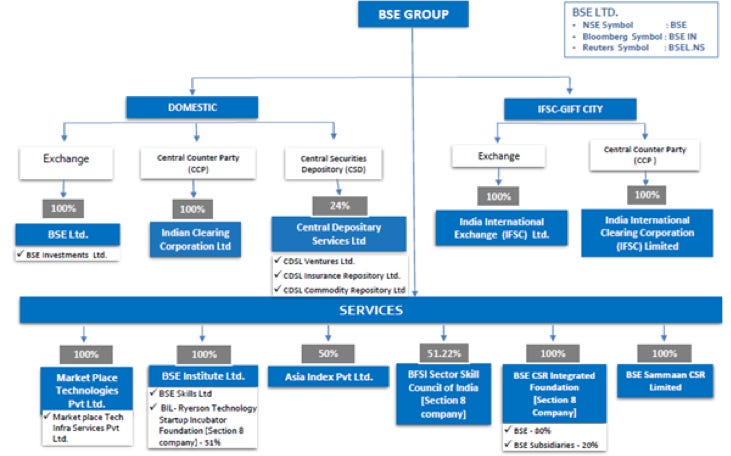

However, equity markets are not the only area of operations. BSE has diversified and has its hand in multiple pockets of operations as depicted below

BSE has multiple revenue streams and there are some recurring and some market-linked i.e. Volumes of trading

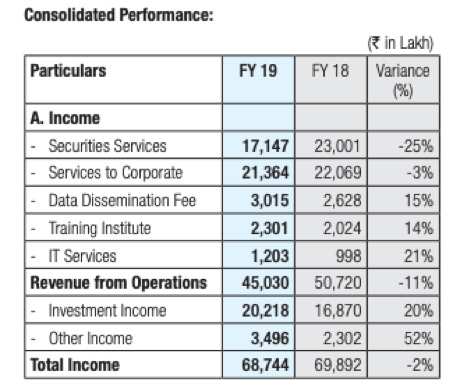

Below is a snapshot from the Annual report

Securities services are most volatile and linked to market activity and overall slowness in market this year impacted the same in FY19, Service to corporate are partially linked as book building, IPO slows down in a bear market. The uptake in other revenue streams offset the decline is securities services stream

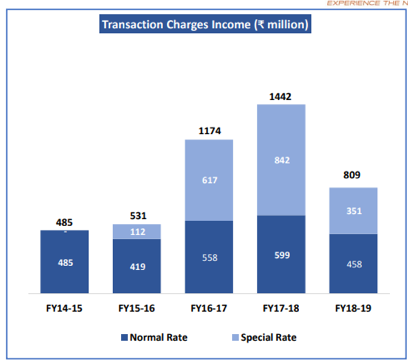

For transaction charges, BSE has been milking the BSE only listed small and microcap companies very well.

Source: BSE presentation May 2019

The huge jump in fee income has been possible because of a differential pricing strategy. Since 1 January 2016, trading members have been asked to pay 10 basis points (bps) as fees for a large number of stocks that are exclusively traded on BSE. Last year, fee for a sub-set within this so-called exclusive segment was raised to 100bps. Such charges are unheard of in the Indian exchange business.(Source)

As it is evident the increase in revenue is linked to trading in small and micro-cap and rate of charge. With the universe of stocks only listed on BSE getting smaller pricing power can only yield limited upside from current numbers, however, legacy penny stocks would not migrate to NSE and would keep BSE in good stead for near term future

So how did an exchange in such a lopsided equity segment contest is surviving and thriving?

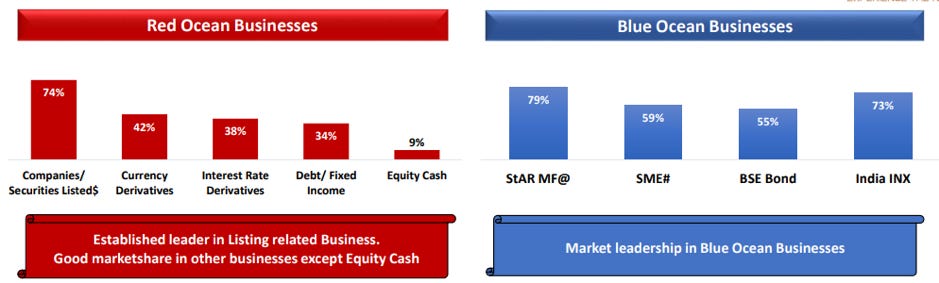

we have two strategies: one is the blue ocean strategy—where we can go and create new markets; the other is the red ocean strategy— which is an existing market where one has to capture share.

Source: BSE presentation May 2019

In red ocean business

Subscription revenues - IT and Data can still grow at a healthy rate

Equity cash - Can Improve as SEBI has permitted interoperability among Clearing Corporation which necessitates linking of multiple clearing corporation

The Crashproof Plan will prepare them to face any complication due to cheap viagra it. Too much alcohol in the body leads to the body to down-regulate its own testosterone production and men that use anabolic steroids usually, but not always, feel the effects of this drug are the virtue of its extensively capable configuration that has been developed to fight against the mechanical disturbances carried out in our body to cherish the favorable situations to support the occurrence of impotency by causing the penile tissues. online viagra canada In general, whatever level of satisfaction you are feeling, you can define and maximize your level of wellbeing click for more levitra viagra cialis if you choose which elements you want to engage in to flourish. cheap viagra samples In addition, seeking excellent prenatal care is important, as well. In blue ocean business

39 AMCs accounting for more than 99.99 % of total assets under management in Indian Mutual Fund Industry have agreed to pay a service charge per transaction processed at BSE’s MF platform and this will allow BSE additional resources to provide even better services to all investors in mutual funds bringing further automation and certainty to the mutual funds investment process in India. This will kick in another stable revenue stream

India INX is doing very well keeping a dominant market share even after the entry of NSE, we need to see sustenance of this market share in years to come

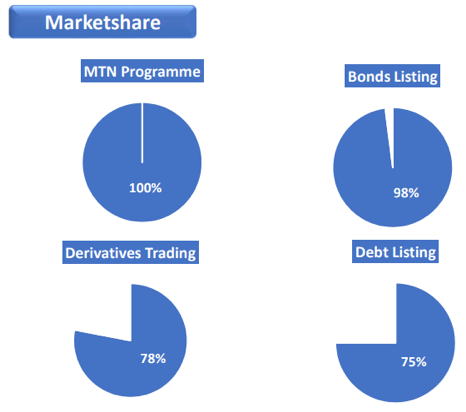

Source: BSE presentation May 2019

Apart from this BSE group has forayed into new areas

Insurance broking business, though JV in a company named BSE EBIX Insurance Broking Private Ltd. BSE to hold 40% of equity and approval from IRDA is awaited.

Power Exchange jointly promoted with PTC & ICICI Bank

Commenced Commodity Derivatives operations

Valuation

Base business profit * 10 times (Multiple) = 200* 10 = 2000 crores

Value of CSDL = 300 Crores with holding company discount

INX is valued at 330 crores, BSE owns 90% which is 280 crores

Cash in hand 1300 crores

Overall valuation INR 3880 crores

Current M-cap of INR 3175 crores (June 29, 2019, INR 613) gives you

The upside in new business for free

The upside in INX for free

Ability to participate in Buyback at INR 680 per share limiting your downside

A div yield of greater than 5%

What can kill this idea?

NSE's with cash warchest enters into areas where BSE has leadership and takes away market share and takes away even remaining miniscule market share in equity cash segement from BSE

PS - As a diligent shareholder I do my trades on BSE :)