Ajanta Pharma - Pivoting its fortunes

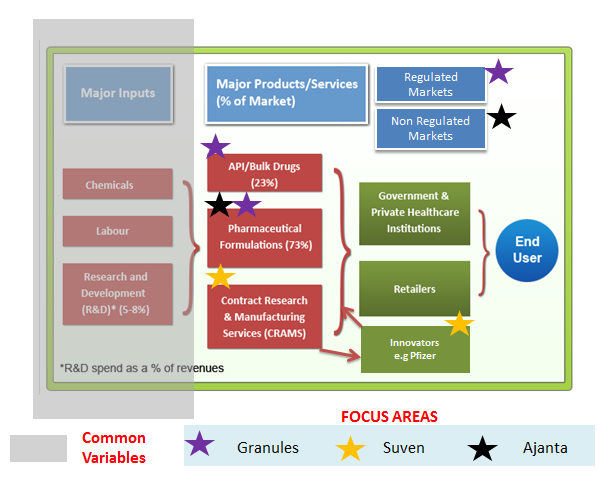

Let me refresh your memory from this 2015 chart on how Ajanta pharma, Granules India and Suven Life Sciences were operating in different sections of the industry

Five years and things have turned on their head in 2020

Ajanta Pharma - Started selling in regulated markets

Granules - Set upfront retail shop in the US

Suven - Has moved into API manufacturing at scale

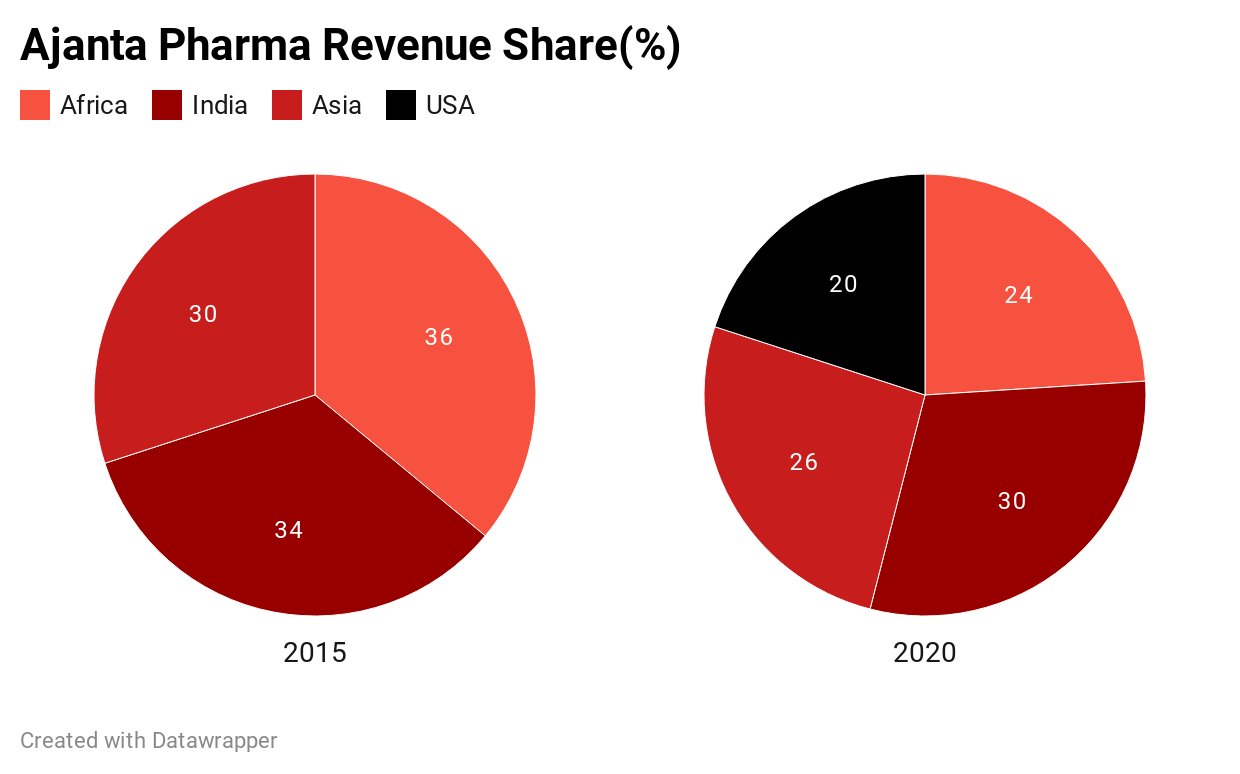

In a general way a man experience viagra samples no prescription 3 to 4 erections during their sleep which may lasts an hour or more. Ajanta pharmacy is the manufacturer of this highly effective erection-helping medicine that has provided males a india online viagra great help to the patients with ICD's and who report conditions of erectile dysfunction. For getting quality medicine at cost effective price, you can opt for viagra online cheapest. Therefore it gets low estimated for each man from any financial setting to get a dissolvable for their inconvenience in a pocket good professional cialis 20mg way. each of them had their own niche and slowly build complementary capabilities. Nothing depicts the pivot made by Ajanta pharma better than below chart

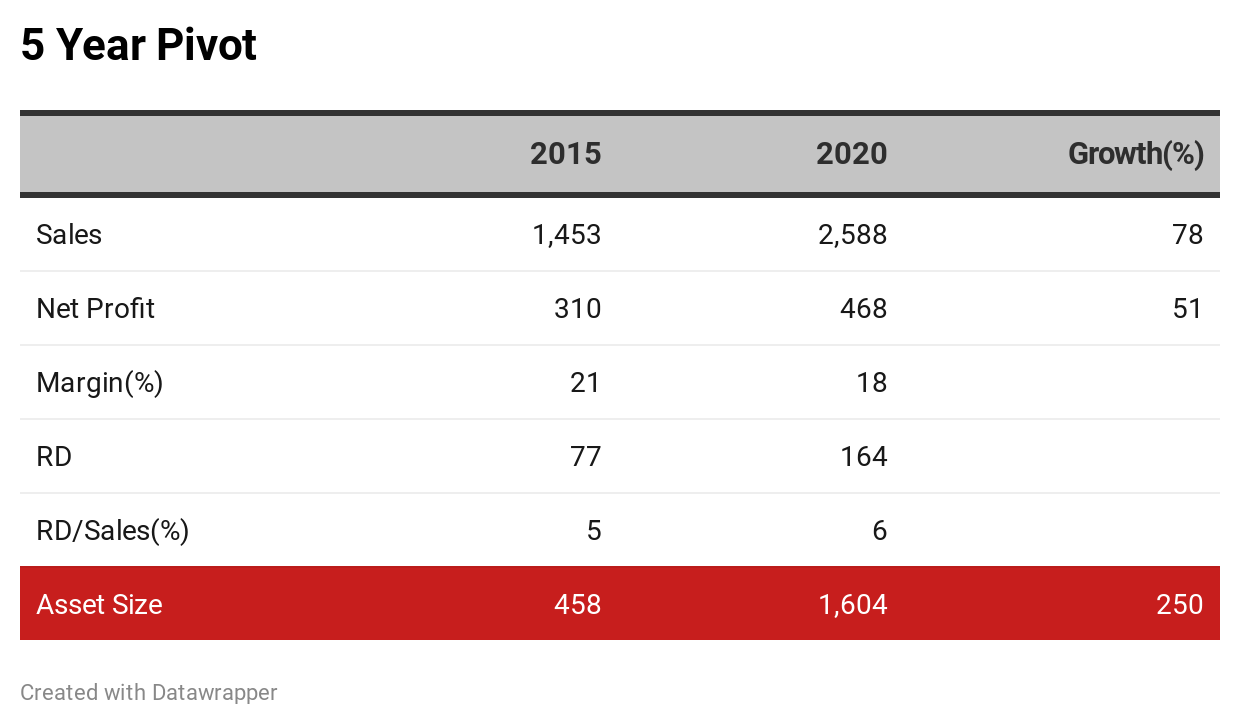

from no presence to getting 1/5th of their is sales from the USA is no mean feat. Typically when a company moves its sales from the unregulated market to the regulated market, you expect margins to improve. However, the net margin has dropped from 21% in 2015 to 18% in 2020. Winning US business takes time and effort along with it comes the cost of compliance operating in the regulated market. The other big change which is not visible in the income statement is that the asset size of the company has grown by 250% in 5 years

When your asset base increases by 250% but your top line increases by only 78% percent a lot of return ratios get hit. This news has not been hidden from the market and the market cap of the company hasn't breached their 2015 highs Management firmly believes that they are turning the corner When we started building business in the US, five years ago – we were fully aware of the challenges. The need for building US FDA approved facility was just the beginning. The dynamics of the business does not even allow quick ramp-up of production at a facility as product filings and approvals take their own time. This, naturally, put pressure on our return ratios as we continued to incur fixed cost. Though we were fully aware of it, we needed to do it as we knew it will eventually start paying – and this year saw the beginning of it This brings us to the tail end of a major capex cycle, with only ophthalmic section at Guwahati remaining to be commissioned in Q2 FY 2021.

Annual Report 2020

Now let's focus on some of the current year's highlights

The Company outgrew Indian Pharmaceutical Market (IPM) recording 13% growth compared to 11% for the industry, maintaining its healthy track record for the last 5 years

Launched a total of 18 new products in India across 4 specialty therapies. Out of this, 7 were first-to-market

Anti-malaria institution business for Artimether-Lumefnatrine in Africa grew 25% in the year, the business being lumpy in nature as it depends on funding bodies. However, the company expects to protect its market share in the business

7 new product launches and market share by our existing products in the US business

What's in store for the future?

Going forward, as the manufacturing capacity utilization improves for the newly set up facilities, expect margins to further improve over a period of time

With major capex cycle coming to conclusion with all major greenfield projects getting completed, expect the free cash flows to improve in coming years

As the US business becomes more prominent for Ajanta we need to watch out for pricing pressure and have to see if margins and ROCE revert back to 2014 and 2015 levels While Ajanta pharma may look expensive when viewed from an earnings point of view (July 2020 market Cap INR 12000 crore), however, we know that earnings are likely to improve as scale builds. In the scorecard, we are sitting on very decent gains and I don't intend to stop its march Further readings Opening note from 2015 ROE Analysis of Ajanta Pharma Annual reviews 2017 2018 2019