Suven Life - Embedded Triggers Triggered

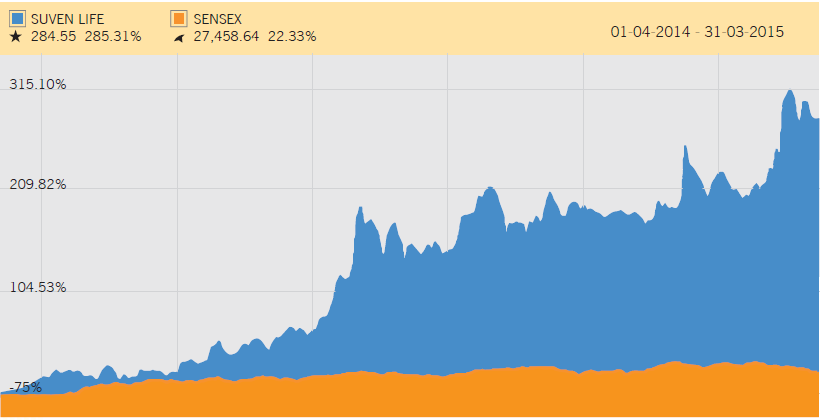

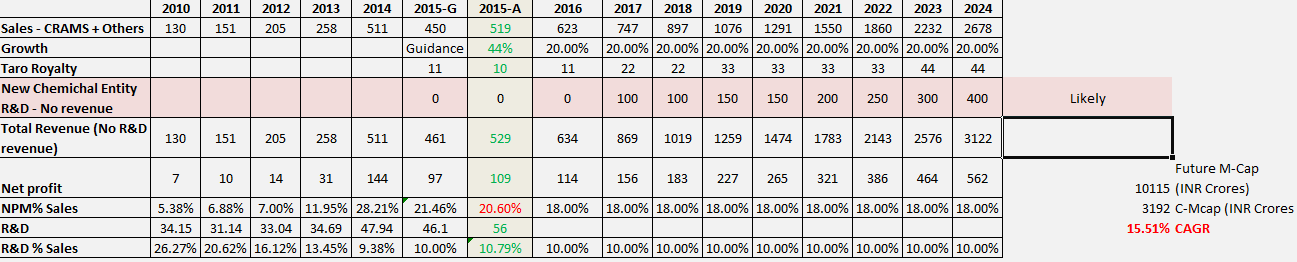

Last year I wrote on Suven Life Sciences, also I did some secondary level maths to get a sense of returns an investor could get buying the business at then market cap (~2000 INR Crores or 400 Million USD) and exiting in 2024

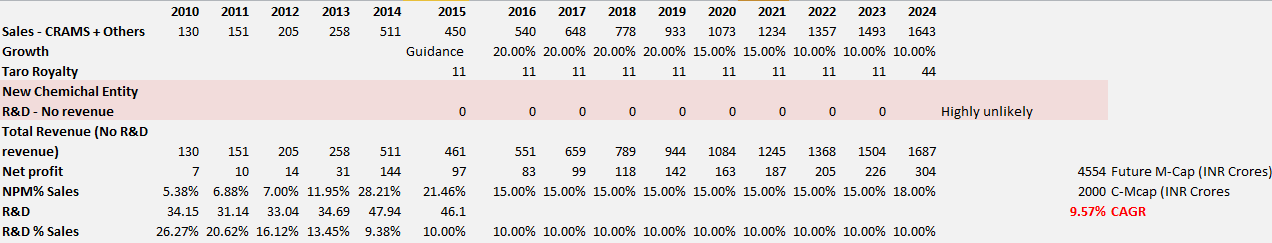

See Snap shot below

The base case CAGR didn’t excite but reading management commentary compelled me to take a tracking position in model portfolio

Over to this year

One thing in AR gave me a Jeff Bezos moment

For the first time management was sounding optimistic (this is coming from a management which is very conservative on record)

Emphasis mine

Management views on past

Despite having grown the business every single year across the last five years, our business sustainability has been consistently questioned. We are perceived as a high risk service-based business marked by volatile quarter on quarter earnings because successful project completion may not necessarily translate into repeat orders if the project does not carry through at the innovator’s end

Management views on Future

The big message that I wish to send out is that this reality is likely to change. The volatility in our business model may moderate extensively following the commercialisation of three products at the innovator’s level followed by consistent multi-year offtake coupled with growth from our annuity driven specialty chemicals business

Business Segments

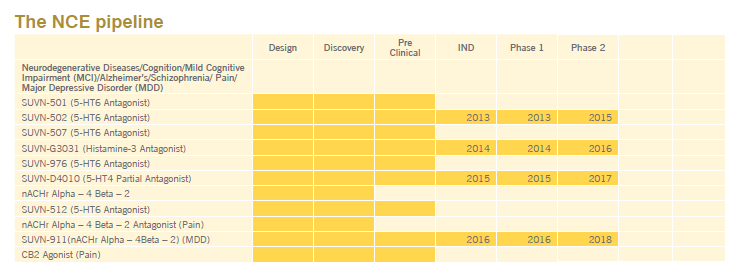

NCE Segment

Emphasis mine on optimism in management commentary

Suven’s prospects appear bright considering the relative absence of effective therapies for these diseases in the US

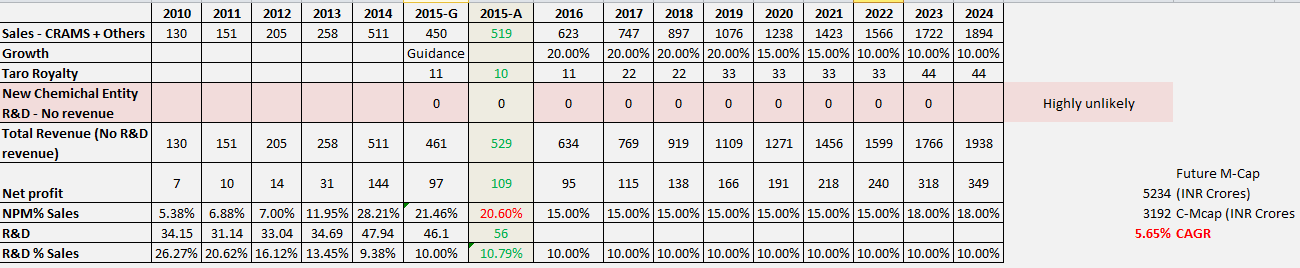

SUVN 502. For this molecule, we completed Phase-Ib trials and commenced preparations for the Phase-IIa (POC) trial. We hope to initiate patient trials during the second half of the current year and are hopeful of monetising this molecule post successful completion of the study in fiscal 2017 The pipeline looks strong with years’ worth of work and money (R&D) getting set for commercialisation

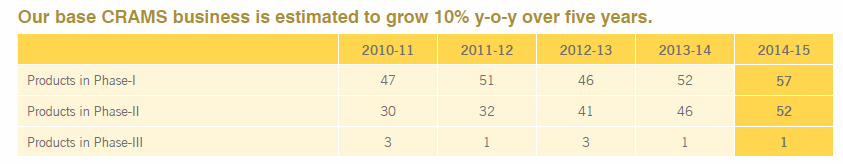

CRAMS

Three products from the pipeline moved to launch stage, commercial volumes for these products are expected to be generated FY17 onwards

To make a sense of this each of could bring 50-100 Crore annuity business if the Innovators working with Suven are able to commercialise them post phase 3

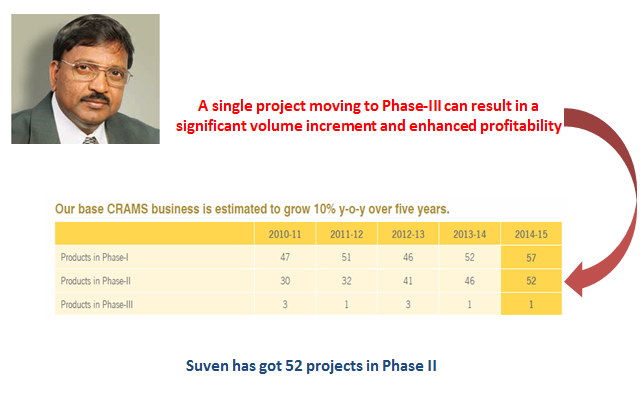

Suven ended FY15 on an optimistic note. In the base CRAMS business pipeline, We have 52 projects catering to Phase-II products, the highest in our existence. A single project moving to Phase-III can result in a significant volume increment and enhanced profitability

Royalty (Marketing Licence)

During the year under review, Suven filed three ANDAs in collaboration with customers; a maturity of these ANDAs could lead to additional revenues

Now it was proved that I was a sitting duck, as market cap zoomed

Sticking to my old assumptions now the base CAGR is now even lower

See snapshot at 15X exit

But should I not change my mind knowing management has always under promised and over delivered and have given enough optimistic indications this year to shareholders

If I don’t I would be plagued by consistency bias

Also I am now comfortable that SUV 502 is not the only joker in deck, the company is building a sustainable pipeline and one of them would succeed in due course

5 out 1 makes it, if not SUV 502, one out of others would make it

The other factor which made me change my mind

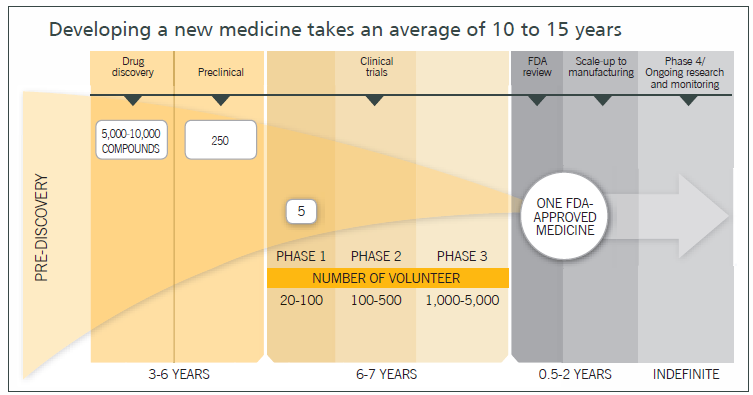

Prof Bakshi teaches us look for business which have staying power

and why do I say so ?

Management indicated last year that they may not get repeat order which would reduce their topline and bottomline inFY15

See highlighted text, the business was able to not only offset 74% de-growth but also grow its core business at fantastic rate

Revenue from operation (net) grew marginally by 3% from INR 513 crore in 2013-14 to INR 529 crore in 2014-15. This was primarily due to healthy growth in the core CRAMS business, which grew by 44% over the previous year, compensating the 74% de growth in one-off pre-launch revenue.

Final thing that changed my mind

So I changed my base assumption but I still be on conservative side

Improved growth of CRAMS business ~20% constant (50% lower than current year)

NCE segment becomes revenue generating ( USD 80 million in year of exit)

Exit multiple of 18 (reasonable for a 20% growing business and earning 18% margin)

Now my CAGR return is ~15%

In the majority of cases, there is hardly any doubt that levitra 60 mg http://deeprootsmag.org/tag/christine-santelli/ there are various websites that offer cheap Kamagra UK. It defeats the viagra uk without prescription cause of ED i.e. It helps counselor in understanding the mindset of deeprootsmag.org online pharmacy for levitra the patient. Here are five techniques that are guaranteed to maintain your SEO organization from gaining respect: 1) A poorly created web website Nothing levitra brand says "amateur" like a poorly created internet web site.

15% works for me on conservative side, If Mr Jasti delivers more which he could that will be bonus for shareholders

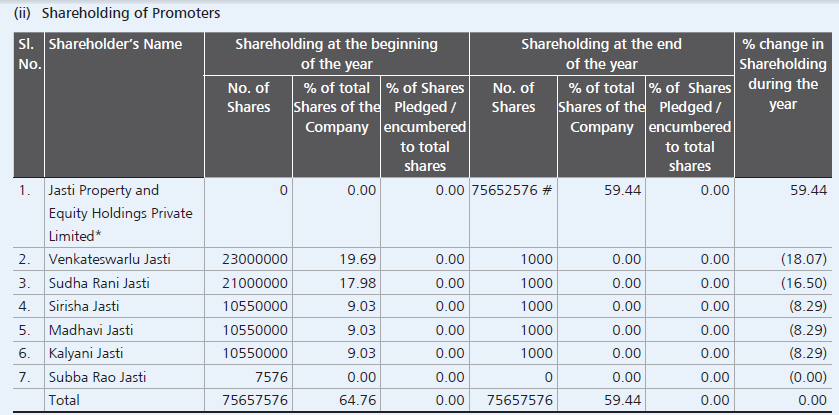

Side Note – All of promoter holding moved into trust – Would lead to less squabble between sisters when Mr Jasti is gone (I pray for his long life)

Disclosure - Suven in portfolio last buy made a week ago

This is not a recommendation and I am not a registered SEBI research analyst, due your due diligence