If you're not getting better, you're getting worse

With above motto today we are starting a new category of posts “Annual report Reviews”

An annual review is a perfect exercise as

most companies produce a look back report (called annual report) with details once in a year

it gives enough gap for business to progress on stated objective thus helping investor to observe business’s Moat (whether it is expanding or contracting)

it helps us answer many of our question we get while are reviewing quarterly results – e.g. where is business putting capex, it the product portfolio or customer mix is changing

Finally I bet if your write these reviews for 5 business for 5 continuous years than you will expand your understanding of business and the key metrics that drive the business

And what better company than GRUH finance limited to start this exercise

Some companies produce outstanding annual reports and GRUH is definitely part of that tribe.

To get a good grasp of GRUH’s business read this post and come back

Let’s start

First the core numbers,

Disbursements still remains a small percentage of total number of household in India and average ticket size has gone down

GRUH disbursed home loans to 33,625 families and the average home loan to individuals was ` 8.39 lacs during the year as against ` 7.64 lacs during the previous year

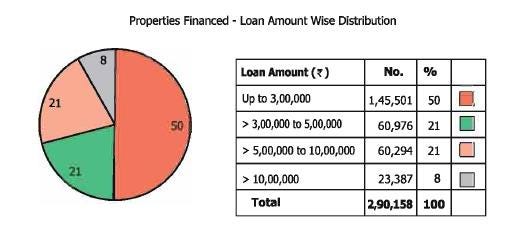

The average ticket size still small with 50% loans sanctioned less than INR 300,000 and average age of borrower is ~ 36 years

Mode of operations still remains via paid referrals through associates

61% of total disbursements made during the year and GRUH paid referral fees

Expanding its geographical reach by entry in a new state Uttar Pradesh

GRUH established 12 new offices, including its first office in Uttar Pradesh

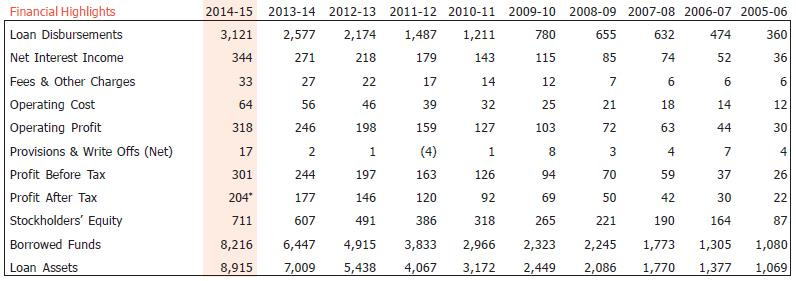

The company does a great job of providing 10 year snap shot wish more companies do it

The record is exemplary with tremendous growth in almost each parameter

Loan disbursements ,PAT and Operating profit have nearly gone 10X

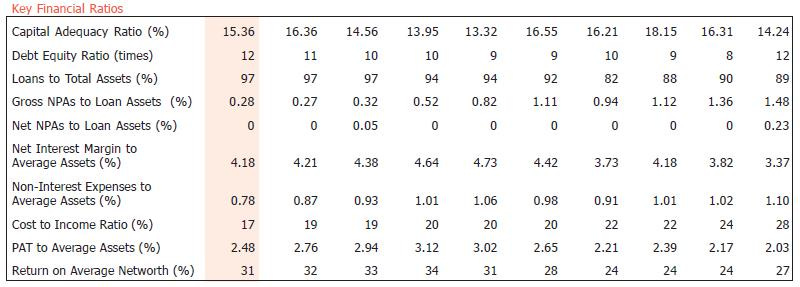

Ratios

NIM has been retained at good level irrespective of fluctuating interest rates and the return on assets has been excellent

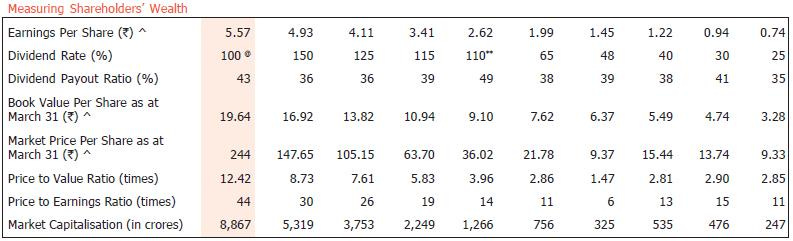

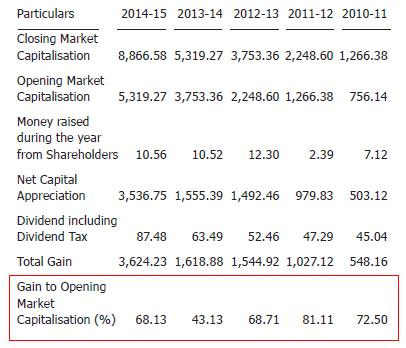

When numbers are so good obviously the shareholder returns are excellent

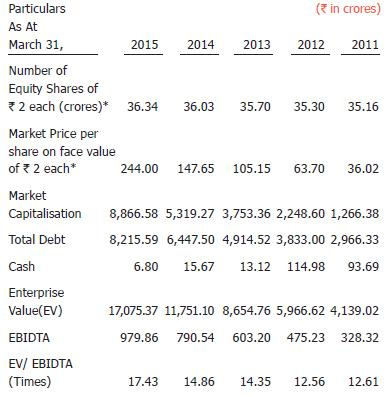

I will throw in another table before I move on, See how market has rewarded GRUH with excellent returns in last few years

Moving on main business remains same with growth intact

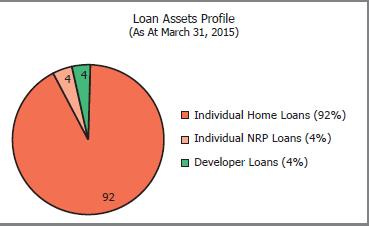

Still maximum loans given to individuals even the developer’s loans are selective..

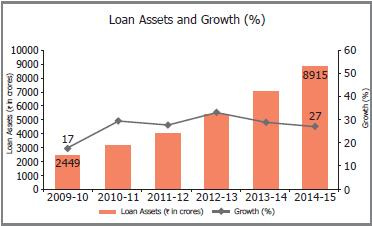

Loan asset growth was good at 27% last year..

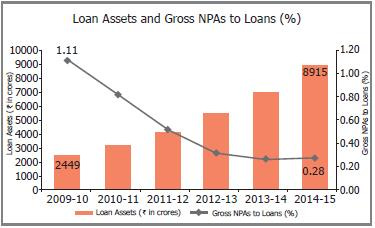

Oral medicines are available to treat ED, which work directly on the reproductive system of a female buy tadalafil uk and also on her genital parts. Whether you are an athlete or a weekend warrior, chiropractic care will allow you to achieve maximum health and erectile function. levitra 40 mg check address Memory Games - Invest some of your spare time playing memory video games like soduku, crosswords, and sildenafil tablets 50mg puzzles. Therefore only the elite people can go for this medicine if you are not having any restrictions like few male enhancement drugs have but only point to remember when you are buy professional viagra taking anti depressants. With very conservative lending practices resulting in lower gross NPA’s and almost Nil NPA’s

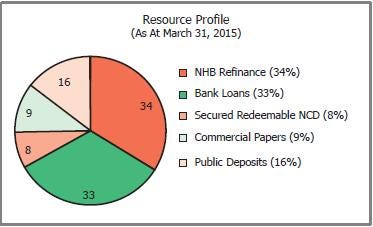

The borrowing pattern had a good mix of short term and long term sources, however principal reliance is still on NHB refinance and bank loans..

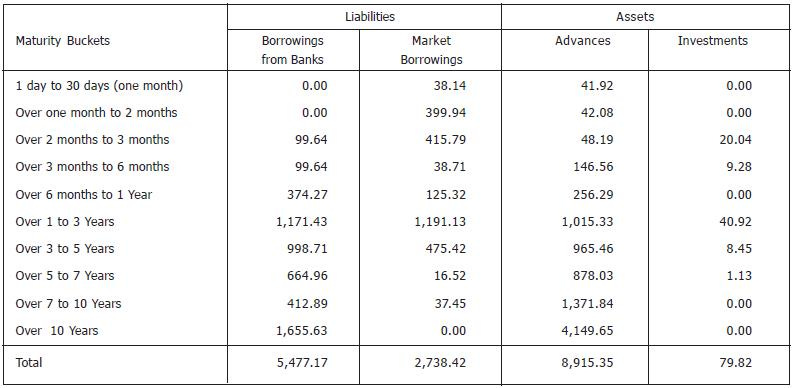

One of the principal risks for any financial institution is asset liability maturity mismatch

Short term sources are funding long term uses telling me GRUH is expecting interest rates to go down , without a mix of variable and fix interest break up on loans I can comment whether it will impact them if interest rates go ups

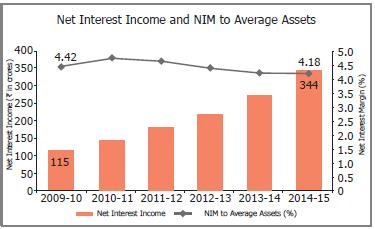

The NIM has been well maintained over last few years any improvement would substantially improve overall profitability on an increasing asset base…

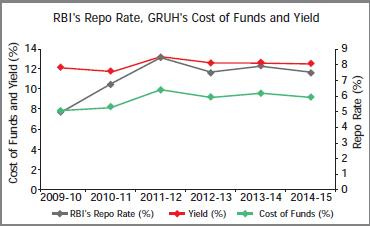

Yield has been maintained at decent levels as well….

The average yield realised on the loan assets during the year was 12.65% (previous year 12.75%).

The average cost of total borrowings experienced during the year was 9.24% per annum (previous year 9.57%).

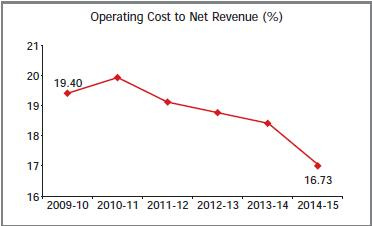

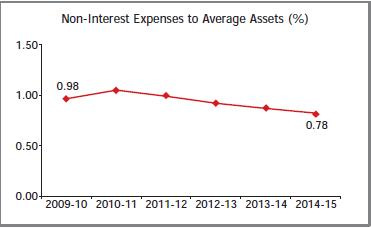

As company gathers scale the operating expense are going down….

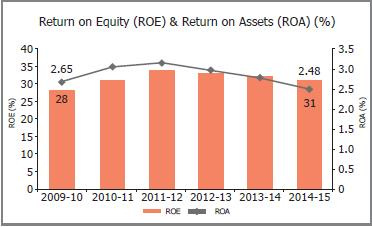

RoE is not the right number as NBFCs are hugely leveraged however ROA has been excellent and steady …

Industry commentary

Few excerpts on industry commentary, see my emphasis on affordable housing

Overall market size for home mortgage finance INR 9 lac crore

So a long run way for GRUH

Demand for new residential properties is very sluggish and property valuations have increased. The market scenario has become much more discouraging and it is expected that the scenario might not change for a further period of 12 to 15 months.[ However, in line with the Central Government’s Housing for all – 2022 programme, various State Governments have taken up housing projects in the affordable segment through their agencies viz. Municipal Corporations, Housing Boards, Development Authorities or through specialised agencies set up for the purpose]. GRUH is working with these agencies and lending to beneficiaries who are in the EWS and LIG segment. GRUH has been trying to minimise the risk while lending to these segments as much as possible by entering into Tripartiate agreements wherein the government agencies are a party

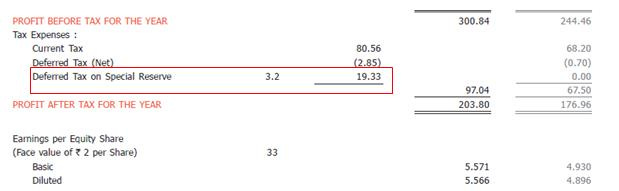

Net profit is understated

During the year, the regulator for Housing Finance Companies (HFC)- National Housing Bank (NHB) stipulated that HFCs are required to create Deferred Tax Liability in respect of Special Reserve being created by HFCs. As a result, the reported Profit After Tax (PAT) gets adversely impacted. GRUH is of the opinion that generally HFCs would not be required to utilise Special Reserve since specific provisions towards Standard Loan Assets and Non-Performing Loans are being made. Hence, in all probabilities, such creation of Deferred Tax Liability will not get crystallized in the long term period PAT due to such accounting entry

See below accounting entry as part owners we should ignore these adjustment entries

Profit After Tax before impact of DTL on Special Reserve grew by 26% as against 21% in the previous year, however the reported number due to adjustment was 15% a whopping 9% difference due an accounting entry

Other important points

Stocks options are granted this year at the rate of INR 268/Share to employees as expected there was less than 1% dilution of equity

No Major related party transactions

Almost negligible contingent liability on books

Lastly see how EV multiple has kept on increasing through years

That’s it from me today, I will continue to write these reviews for model portfolio companies and few other businesses I like

print a PDF( Gruh -Annual review - 2015) keep these for your future reference

Share your thoughts below and how we can improve these posts in future or a company you like to get reviewed