Invest your house EMI in equity markets

Earlier I wrote a post to convince you that you should buy a house against renting, Today let’s build a case of buying house on EMIs vs investing equated monthly investment (EMI ) in capital markets

Base case

Cost of house – INR 60,00,000

Down payment – INR 12,00,000

Term – 15 years

Rate of interest – A quick search would tell you ~10% floating rate is the going rate , See below snapshot from www.bankbazaar.com

Typically as an economy scales up the interest rate goes down, See an example of South Korea , A nation which has moved from being a developing nation to a developed nation

Therefore for our base case example we can say that consumer is likely to pay a lower EMI in future however to be conservative I will assume EMI to be constant

EMI – INR 51,463 /month or INR 6,17,564 / Year

To complete my calculation I need to make few more assumptions , Rent yields let take a look at what are rent yields across the world now

In 15 years India as an economy should be closer to China / Singapore in real terms so I can only make an educated guess

Rent Yield – Year 1 3.80% , Year 15 – 2.50% (as interest rates would drop) , We need rent yield to calculate how much consumer would be paying rent in case he is not buying house but renting a similar one

Growth rates in India’s property prices had been phenomenal , read this article for more insights

In long-term as we know real estate is good hedge against inflation, The cost of owning a similar house should we today’s price multiplied by long-term inflation forecasts

Let’s review few forecasts

IMF - forecasting inflation rate to be 6% by 2019

OECD - GDP Forecast

EIU - forecasting inflation rate to be 6% by 2018

To be on conservative side I would take the following assumption

Property price appreciation - 8% per annum for next 15 years

The final jigsaw in my puzzle is long-term equity returns, A normal investor is not Warren Buffet so he has to take assistance to invest his money intelligently in equity markets this is were he turns to great Indian money managers

Who are they ?

Some on top of head

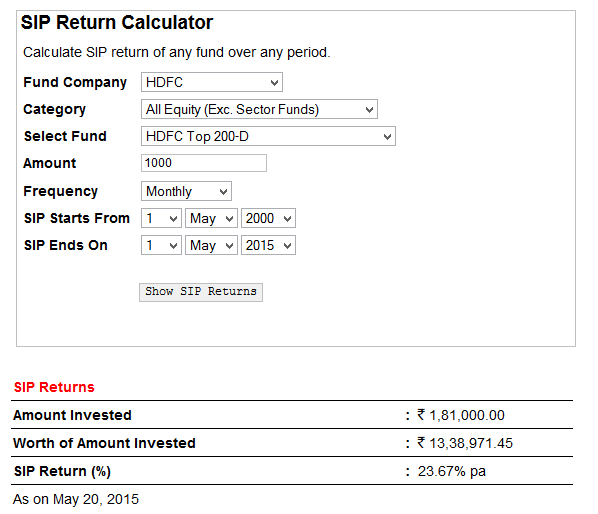

This is SIP return for his fund for last 15 years a staggering 23.67%

He has done a CAGR return of 23.78% return in last 10 years as SIP on his funds

I just gave two examples but there are few more money managers who have a fantastic long-term record

Look at below performance of select 10 year performance of few funds (all in CAGR)

What is the point I am trying to make ?

Over long periods of time in past sticking to good funds and fund managers have given a regular investor CAGR return in range of 20%

Would it happen for next 15 years, With economy expanding, opportunities increasing the likely hood is high but I would moderate my expectation

Long term return on equity investments – 18% CAGR

Putting this all together :)

In 10 years,

The amount invested with a reputed money manager with long-term record would grow to a sufficient amount to buy the same house today – Debt Free !

In 15 years,

You would have almost 50% more than what would be required to buy a similar house

This is where I end my base case on proving why instead of paying your home loan EMI if you invest in equity markets you will become debt free faster

How many people reading this would do it ?

May be 1 in 50 reason,

Equity returns are not in straight line so they would not advance as shown in table above, it would require huge courage to be disciplined with EMI to markets ( for home loans we don’t have a choice)especially in times when you see prices dropping everyday

Having an owned home has huge emotional satisfaction so people would happily opt for being borrowers for long-term

Family pressures – Investing your EMI in share market would bring you scathe of your wife , children & parents who might label you as gambler ;)

What are the odds that MF or Indian companies would do well in next 15 years let me go back to my cocoon and own a house

This is a risky strategy and might leave me homeless after 15 years when my earning power would be low and my financial commitments would be high

Will you do this in your personal situation ?

Share your thoughts below