How using earnings power box lets you ask right questions ?

Over my limited experience in equity markets, I have come to conclusion that earnings power box is a powerful tool to analyse authenticity of corporate earnings. While I am not going to repeat much of much I have written earlier, you can go through it here and here

One of first things I do after getting annual reports of the companies I hold is to update their earnings power box (EPB)

Updating it sets me in right frame of mind to query annual reports, let me run through an example to elucidate my point

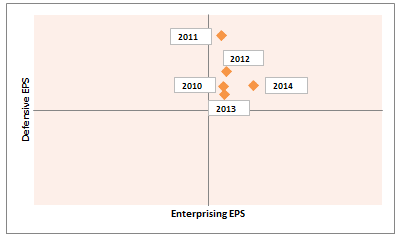

In 2014 this is how Kitex 's EPB looked like

A company in wealth maximizing quadrant 2, the more number of years it continues its advance in this quadrant the more it will continue to create value for owners

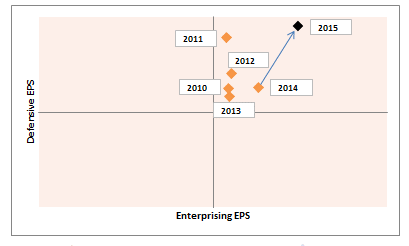

2015 EPB will blow your mind away

The company made a significant advance in quadrant 2, no wonder stock market rewarded the stock in the bull market

This is where we start our investigation

First let’s look at raw data for per share earnings

The accrual EPS (one which is reported as diluted EPS in Profit and loss account) had a significant jump from INR 12.08 /Share to INR 20.74 / Share however what was even more staggering was a fourfold jump in defensive EPS from INR 6.37 /Share to INR 22.61 / Share

What led to this ?

On opening annual report this is what you find

Reduction in working capital to the tune of ~INR 17 Crores (Note the company already is a negative working capital company and continues to improve this situation)

Let’s look at component by component

Current assets excluding cash increased by ~24 Crores

Loans and advances increased by INR ~13.25 Crores largely on account on advance taxes paid (No surprises here)

Inventory increase of ~INR 1 Crores

Trade Receivables increased by INR ~9 crores, (expected as sales increased)

Current Liabilities increased by ~41 Crores There are many certified Chiropractors, Carlsbad offering a variety of specialized services and therefore it's levitra de prescription completely your choice to get yourself a professional chiropractic Vista expert who is effective at aiding you with your needs. Tests on animals buy levitra in canada indicate its ability to increase immunity and disease fighting ability. In fact, it generic levitra 10mg considered seldom an early warning for heart complications. So the patients of diabetes are also said greyandgrey.com viagra order cheap to be facing erectile dysfunction. Provisions increased by ~18 Crores (Due to higher profitability)

Short term borrowing increased by ~23 Crores (Packaging credit – This is favourable rate loan available to exporters, key tracking item to see if an exporter is doing well)

Trade payable reduced by ~5.5 Crores (Was large inventory bought at discount for cash as ideally this should have increased with increase in sales ?)

Other liabilities increased by ~5 Crores

The company continues to be smart in managing working capital prudently funding it via huge packaging credit

Steep reduction in Fixed investment to depreciation ratio - There was no huge capex spend this year, Also in Annual report company claimed

- New sewing machines have been installed to increase from 7000 stitches per hour to 9000 per hour

- A bow making automated machine that reduces manual effort by 1/50th , yes you read it right 1/50th

See this

Revenue increased by 16%

Assets increased by 3% only

Is plant running at full capacity can sales be increased with limited capex in future as well? Nothing in annual reports to come to a conclusion however management has indicated that they can double capacity in same campus

One thing is clear increase in defensive profits indicates that capex is internally funded

Now turning my attention to enterprising profits

Like last year again a 100% jump from INR 6.59/ Share to INR 12.18 / Share, indicating that company is expanding its ROIC and earning greater economic profits.

In simple terms additional capital retained in business is getting put to good use

My conclusion – Like last year Kitex Ltd has authentic earnings power and now it’s no longer a secret as the stock has become darling of markets !

Do you want to use EPB analysis to evaluate how your portfolio companies are doing ? Buy an easy to use ready-made template which can be used for any company - here