Why you should not mix emotions and investing

I love the below quote related to emotion and investing

Emotions can be a great asset in life, but when it comes to investing, they may be a liability

Very important line and one needs tremendous patience and practice to avoid mixing emotions with acumen when making an investing decision

Let me tell you story of Anil, a retail investor,and how his emotions cost him dearly

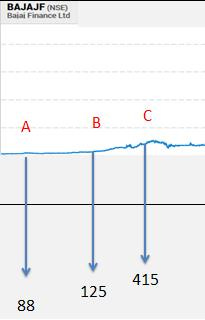

Few years ago his friend told him about an established NBFC Bajaj Finance as a stock tip, he looked at the company’s ticker it was INR 88, he added stock to his watch list and waited for price to drop so that he can buy

A year went by and one day while browsing prices of his watch list he was stuck, Why ?

The stock suggested by his friend has moved almost 50% up, there was huge guilt in him on having missed 50% returns but then he consoles himself by saying ‘We can’t make money on every stock in markets’

He thought this would be end of his story with Bajaj finance, but almost a year later he saw a print ad of the company in newspaper and something coaxed him to check the stock price. This time he was disheartened

A 3 bagger missed, he could not eat whole day thinking why he didn't buy the stock when his friend told him at INR 88 few years back.

Time moved on so bad memories were forgotten, a few years later there was a huge crash in equity markets, The anchors on TV were screaming that this is going to be the end of world. Watching TV was disturbing but he kept on watching and one fine day what he saw amazed him

Bajaj finance was available at a price lower than price he could have bought years ago, but he was worried what if TV anchors are right and the company becomes a penny stock. He feared that Bajaj’s fate would be similar to other stocks in his portfolio which are going down in drain. He switched off TV

Almost two years later he got a sweets box as a new NBFC has just opened a branch near his home, he opened the invitation card. The invitation was from Bajaj Finance, The first thing he did before opening the sweet box was to check stock price of Bajaj finance ,this time he was inconsolable

Previously he missed a 3 bagger, this time the miss was huge a 10 bagger. He was restless and extremely disappointed but what can he do now ? Nothing

Years later a day while checking email from his broker he got a note on company which they thought would benefit from change in central government. The price at which the brokerage house was asking Anil to buy this company was INR 1455 and the company was Bajaj Finance

He was literally offended - how can Broker offer him a company which he could have bought for INR 600 a while back, he threw report in trash can. Although secretly he was whining that he again missed a 2 bagger

Today while browsing policy bazar com , for financing his new car he got lowest quote from a company

Guess which company ? – Bajaj Finance, What is the next thing he did ? ?

Yes he checked the stock price

Now he literally hated this stock and vowed never to look again at its price chart

Story over

....Now how many of us have somewhat similar stories to share ?

I am sure many of us at least, I have but may be that will be a new post

What emotions were triggered at various points in above chart ?

A: Hope (Anchoring to a price)

B: Guilt

C: Even more Guilt

D: Fear, The herd instinct is at the strongest

E: Disbelief

F: Resentment

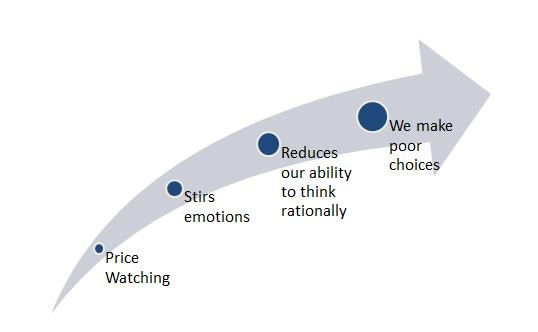

What happens when we are under emotions ?

The more emotional an event is the less sensible people are – Daniel Kahneman

In short,

"Only when you combine sound intellect with emotional discipline do you get rational behavior." - Buffet

Remember great investors are not unemotional, but are inversely emotional – they get worried when the market is up and feel good when everyone is worried

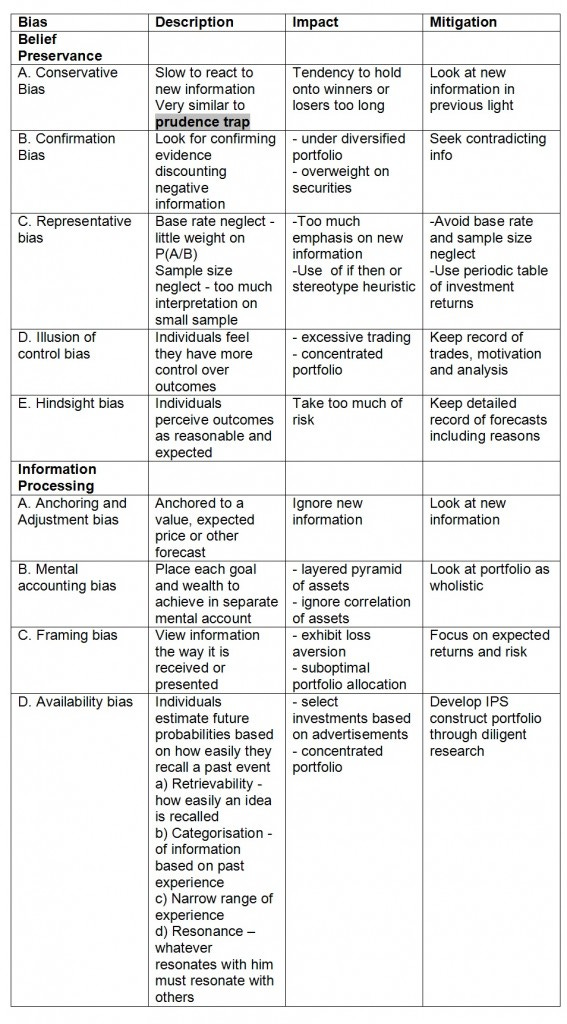

How can we can mitgate some these emotional biases ?

I am reproducing two tables from my boook for CFA students, Keep them handy for mitigating baises in investing

Registration Status with SEBI:

I am not registered with SEBI under SEBI (Research Analysts) Regulations, 2014. As per the clarifications provided by SEBI: “Any person who makes recommendation or offers an opinion concerning securities or public offers only through public media is not required to obtain registration as research analyst under RA Regulations”

Details of Financial Interest in Bajaj Finance:

Currently, my close relatives own stocks of Bajaj Finance ,But their purchase price is substantially lower than current market price. This is not a recmmedation to buy at CMP,Please consult your financial advisors before taking any buy/sell/hold decision. I may change my opinion post publication of this note and may not be able to update because of time constraints.