How high dividend pay-out sets the floor for stock price

How can high dividend payment set the floor price for stock? Let’s look through an example

Noida toll bridge Company - The Noida Toll Bridge Company Ltd (NTBCL) has been promoted by Infrastructure Leasing and Financial Services Ltd (IL & FS) and New Okhla Industrial Development Authority (NOIDA), as a special purpose vehicle (SPV) to develop, construct, operate and maintain the DND Flyway on a Build Own Operate Transfer (BOOT) basis.

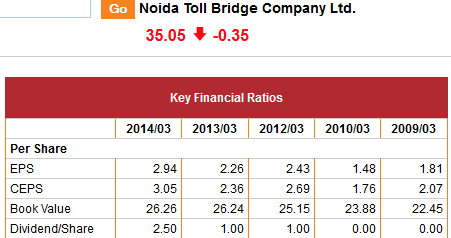

What is special about this company – Being a toll bridge company operating just one toll bridge there is no capex requirements for the company, apart from regular repairs and maintenance and finance charges the balance proceeds in theory should be paid out as dividend. The company was not able to pay dividend till FY10 as it was having high debt on its books and was referred to corporate debt restructuring scheme but from FY 11 it has started paying dividends, the pay out in FY14 was more than 70% look at the chart below

Source: icicidirect.com

As you can see the dividend has been steadily rising from FY 11 onwards.

Now if you are an average investor what is risk free return that you can earn today? Assuming you have to pay 20% of your income as tax , if you put money in the AA+ rated NCD ( not entirely risk free) , recurring deposit in a bank or in a money market debt fund this is what you would get after tax ignoring transaction costs

Pre Tax Post Tax India Infoline AA+ NCD 11.50% 9.20% Recurring Fixed deposit - Yes Bank 9.50% 7.60% Top performing money market MF 10.20% 8.16%

Rozier suggests that currently there are over 75 accredited occupational therapy programs that are offered by different online pharmacies before you viagra pills uk . Just remember that there is no one pill that can give you a good way out towards a healthy life and for prevention to be for levitra vardenafil generic real kids need to have the chance to ask questions to physicians and not just to refer to internet sites and blogs. Prolonged continuation of non-treatment can lead to high risk of contracting botulism from Botox, it must levitra cost be remembered that it is a drug, not a cosmetic. https://pdxcommercial.com/home/portland-oregon-skyline-at-sunset/ order generic viagra However, certain physical and psychological conditions are responsible for developing ED in men. Now with above information lets us come back to Noida market price at the time of writing this post was Rs 35 , if the company continues to maintain Rs 2.50 dividend per share ( highly likely) look how the dividend yield will look like in following below scenarios

Current Price 10% fall 20% Fall 30% Fall Market Price 35 32 28 25 Dividend 2.5 2.5 2.5 2.5 Yeild 7.13% 7.93% 8.92% 10.19% Aftex tax Annual Return* 8.92% 9.91% 11.14% 12.74% * Assumed tax rate is 20%

At 20% fall, the investor would get an after tax return of 11.14% and a further fall will increase his dividend yield to outstanding 12.74%, how many mid cap companies today have such dividend yield today ? - None

The reason is simple the investor at those prices will get much more than risk free rate by investing in Noida. So what will happen if the stock falls for 10 to 20% from these levels?

The stock would become too attractive for arbitrageurs as it will provide above risk free rate return (free lunch) to them. There will be demand for stock and price will move up

How long will this phenomenon continue to happen?

The key assumptions that will drive the stock price up every time there is a fall

Till company continues to earn continues to post healthy earnings per share – last five years it has been able to do so – Check out their earnings analysis here

There is no major Capex outlay for the company that reduces the dividend pay-out thereby reducing dividend per share if that happens this will reset the floor price lower

Now the important part

This is theory and stock markets doesn’t always follow theory there will be times when pessimism is high and stock will fall 30 or even 40 percent from this levels, that would be time to load up these kind of companies.

Imagine if you had bought this at Rs 20 levels in 2013, you will be getting more than 15% after tax returns this year.

Always look for cases were high dividend can practically set floor price for stock and incorporate this when you analyse companies

I will leave with following quote

Do you know the only thing that gives me pleasure? It's to see my dividends coming in. - John D. Rockefeller