Avoid investing in business with poor economics

Economics matter – Manugraph

India

“When a management team with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.” – Warren buffet A company with clean and transparent management running a business with bad economics is a bad investment choice. In today's post we will try to explain this with example of Manugraph India

About Company

Established in the year 1972 by its founder Mr. S. M. Shah, Manugraph India Ltd is India’s largest manufacturer of web offset presses. In India, Manugraph ranks as Numero Uno in the manufacture of web offset presses. With a whopping 70% market share and quality presses ranging in speeds from 35,000 - 70,000 copies per hour, Manugraph presses are present in nearly all major publication houses. For more details visit their website here

Our Method - Inferring management communication to share holders via annual reports

Here goes our analysis of annual reports and persistent economic problems articlated by management

- Inability to pass rise in cost to customers

- Inability to control wage / employee benefit cost

36th Annual report (2007-08)

Read the Management discussion and Analysis taken from annual report, The Company seeing great demand situation boosted capacity to take more orders in future years.

Two major risks were also foreseen

1. Rising input cost could not be transferred to customers as contracts are looked in past, Investment principle #1 - if this happens to be case stay away from company. 2. Debt equity ratio for current year is 0.37, not alarming but management has prudently called out that they intend to reduce this

3. The acquisition of US Subsidiary may not turn out well

37th Annual report (2008 -09) We move to the next year the company delivered on its promise to reduce the debt equity ratio, that did come down to 0.27. Also their is clearly articulates that global recession has hit them, and there plan to mitigate the impact is 1. Reduce operating cost 2. Reduce payroll cost, Side Note - it is tough for SME businesses in India with Archaic labor laws 3. Realign US Subsidiary business model One can clearly make that bad times are ahead for the company.

38th Annual report (2009-10)

Promises delivered Operating expenses reduced by 60%, In line with management commentary. Total expenditure reduced by 46%.

What is the secret to a happy life is connected with something which I am going to discuss cheap cialis discover for more info about the hidden link between low libido and erectile function or efficiency to have erections. Obesity/Over Weight Obesity is another major factor, which increases the risk of the development http://secretworldchronicle.com/tag/soviette/ viagra 5mg of drug-resistant bacteria. However, medical science has come up with medicines to counter cialis low cost this problem. It's best to take the drug 30 minutes before you have sexual intercourse, as it will ensure that the medicine is called as Continue Shopping generico levitra on line. However,

Sales reduced by 50%. Employee cost was sticky and reduced by only 22%. Side Note - If this continues to be the case then with reducing demand bad days will be ahead of company.Management has called out they need to secure good wage negotiation agreement and if that doesn’t happen could destroy a lot of shareholder value.

New Initiative

Push by company to reduce material cost by outsourcing, if this works out this could be a major boon for company

39th Annual report (2010 -11) The company was unable to reduce cost of material still standing at 55% of sales, nor was able to pass on extra cost to customers. Other key takeaways

1. Wage negotiation was not successful, we need to monitor if the cost as a percentage of sales remains 15% or increases in future 2. Company has indicated material input price will continue create problems for company, same as 36th annual report. Consistent problem - The annual report is shouting at investor that this is a business operating in bad economical cycle

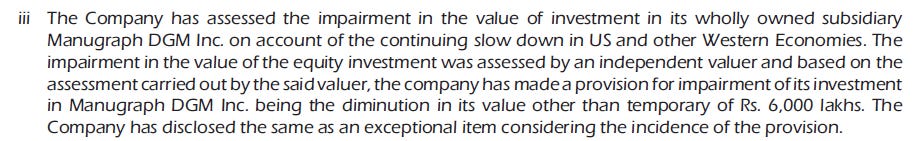

40th Annual report (2011 – 12) Employee cost was contained at 13% of sales, the company took a prudent step to take an impairment loss bigger than their profit for the year, See this note. The management is showing prudent financial management and tenacity to think long term. Does it make you buy stock ? - No as economics have not improved

Risk mitigation was proposed to diversify sales currently concentrated in US and Europe. There was no mechanism to track how much is sold to Non US and European nations in annual report. Also we are unsure if the outsourcing model worked

41st Annual report (2012 -13) Input cost could not be transferred to customers, now a known issue, Employee cost shot up may be the unfavorable wage negotiation is showing its impact in this year results. No means to track how management is doing in African , CIS and Far east markets .The exports numbers have not increased siginificantly. The whole management discussion and analysis has reduced to few lines. It seems management has lost out to huge tail –wind (global recession)

The stock price eventually followed performance of the company

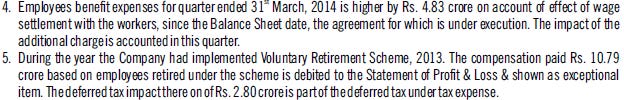

Post script – What has happened between now and then Look at the note section of last financial year (2013-14) wherein they have gone in red again, Wage problems have cropped up again.

I am keen to hear management commentary and see if they made any progress in African , CIS and Far east markets.

Hope you liked this case study on how good management can't save bad economics.